WTI Crude: Breaching Below the USD80.00 Support

rhboskres

Publish date: Thu, 18 Nov 2021, 06:05 PM

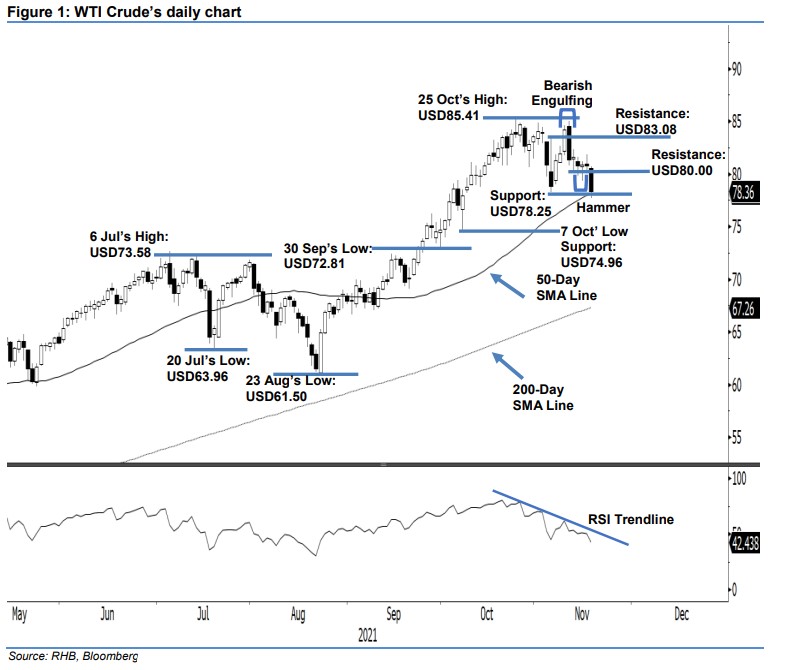

Stop-loss mark triggered; initiate short positions. The WTI Crude continued its downward movement yesterday as it fell USD2.40 to settle at USD78.36 – below the immediate support that is also the stop-loss threshold. The commodity started off on a slightly negative tone at USD80.54 and gradually moved lower throughout the session – it hit the day’s high of USD80.69 during the opening hour while touching the day’s bottom of USD77.69 during the late US trading session. The long black body candlestick below the USD80.00 level has shifted the sentiment towards negative territory. The WTI Crude should chart below the 50-day average line in the coming sessions – in line with our earlier expectation. Since the stop-loss level has been triggered, we shift our positive trading bias to a negative one.

We closed out our long positions – initiated at USD84.15, ie the closing level of 9 Nov – after the stop-loss mark at USD80.00 was triggered. Conversely, we initiate short positions at the closing level of 17 Nov, ie USD78.36. To manage the downside risks, the intital stop-loss threshold is introduced at USD83.08.

The support levels are adjusted at USD78.25 – 4 Nov’s low – and USD74.96, or 7 Oct’s low. Conversely, the nearest resistance level is set at USD80.00 – its support-turned-resistance – and followed by USD83.08, ie 3 Nov’s high.

Source: RHB Securities Research - 18 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024