COMEX Gold: Hovering Sideways Below the Immediate Resistance

rhboskres

Publish date: Fri, 19 Nov 2021, 06:52 PM

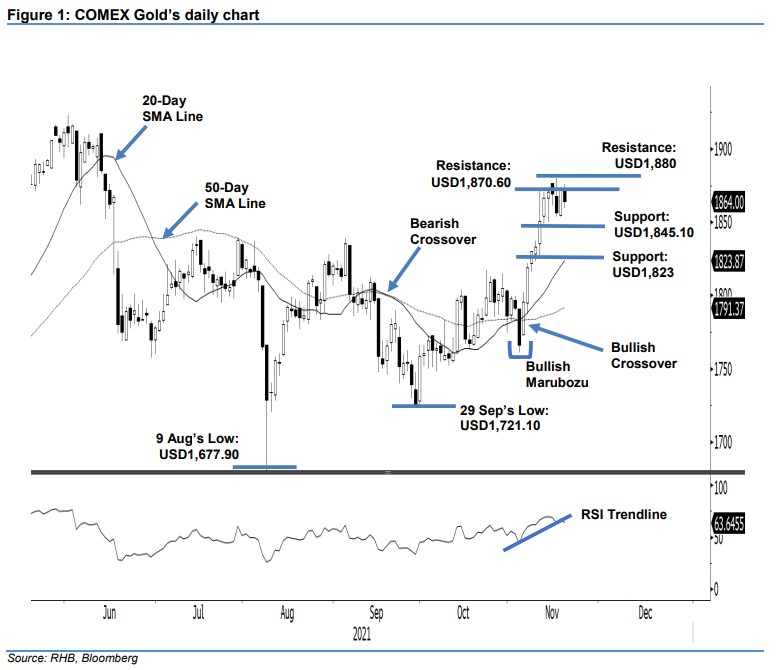

Maintain long positions. The COMEX Gold Feb 2022 futures contract saw profit-taking near the immediate resistance yesterday, pulling back USD8.80 to settle at USD1,864. The commodity started off at USD1,871.70 and tested the day’s high of USD1,875.90. Bullish momentum ended at the resistance, and selling pressure emerged during the US trading session, dragging the commodity towards the session’s USD1,859.40 low before the close. Despite yesterday’s weak price action, it printed a “higher low”, signalling that the bullish structure remains intact. The commodity may consolidate sideways before a fresh attempt to cross the resistance. As long as it continues to trade above the USD1,845.10 support level, we think the upside risk remains. We hold on to our positive trading bias.

We recommend traders retain the long positions initiated at USD1,793.50 or the closing level of 4 Nov. To manage downside risks, the trailing-stop is set at USD1,845.

The immediate support is revised to USD1,845.10 (11 Nov’s low), followed by USD1,823 or the low of 10 Nov. The nearest resistance is pegged at USD1,870.60 (10 Nov’s high), and the USD1,880 whole number.

Source: RHB Securities Research - 19 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024