WTI Crude: Falling Below the 50-Day SMA Line

rhboskres

Publish date: Mon, 22 Nov 2021, 08:44 AM

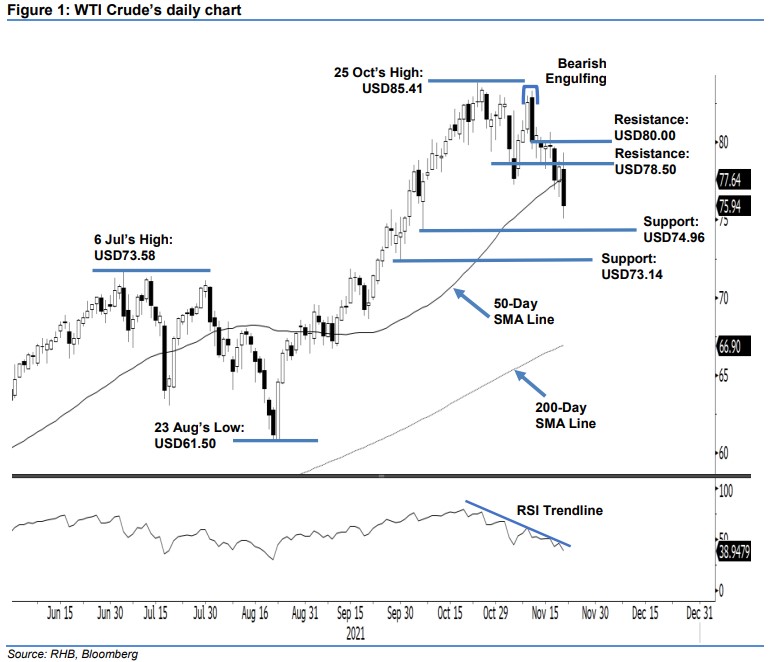

Maintain short positions. The WTI Crude’s Jan 2022 futures contracts failed to sustain above the 50-day SMA line last Friday, plummeting USD2.47 to settle at USD75.94. The commodity started off at USD78.29. It initially rose higher to test the USD79.33 day high. However, selling pressure intensified during the European trading hours, dragging it towards the USD75.09 day low. The WTI Crude then closed at USD75.94 where it formed a bearish candlestick. With the latest price action, the commodity is now trading at its 6-week low. Coupled with the RSI pointing downwards, it is likely that the negative momentum will follow through in the immediate sessions. While we do not rule out the possibility of seeing a technical rebound soon, we expect the 50-day SMA line to act as a strong resistance right now now. As the selling pressure is persisting, we hold on to our negative trading bias.

We advise traders maintain the short positions initiated at USD78.36, ie the closing level of 17 Nov. For trading-risk management, the stop-loss mark is revised to USD80.00 from USD82.33.

The support level is revised to USD74.96 – 7 Oct’s low – and followed by USD73.14 or 30 Sep’s low. On the upside, the nearest resistance level is pegged at USD78.50, followed by the USD80.00 round number.

Source: RHB Securities Research - 22 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024