FKLI: Retracing Towards a Consolidation

rhboskres

Publish date: Tue, 23 Nov 2021, 08:45 AM

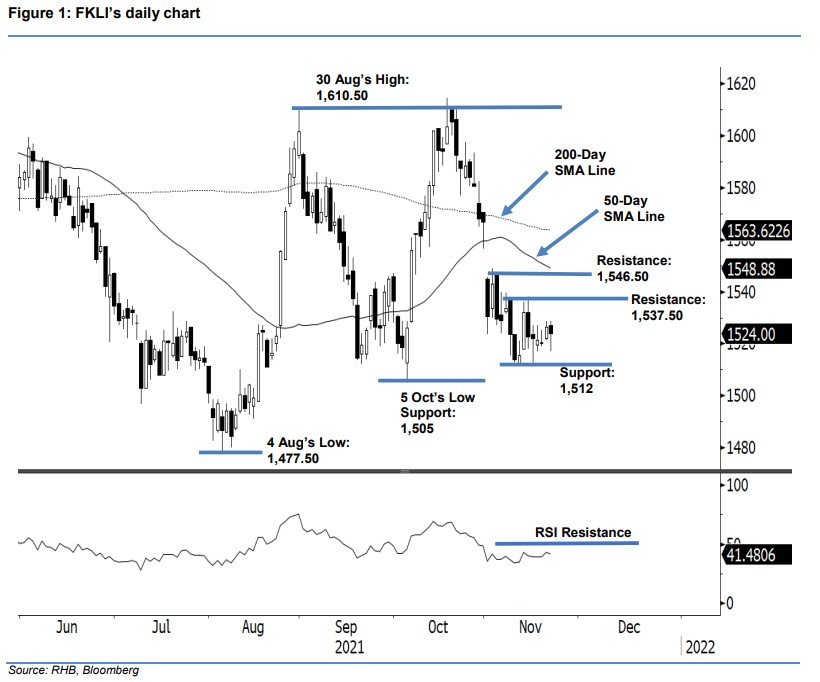

Maintain long positions. The FKLI underwent selling pressure early on Monday, but then rebounded and recorded a smaller loss. The benchmark index opened at 1,527 pts, but sudden bearish pressure dragged it to the day’s low of 1,517 pts. Thereafter, buyers rapidly seized the bargain and lifted the index back above the opening level. The index managed to test the day’s high of 1,528.50 pts, before closing. The latest session confirms that the downside risk has been minimised currently. The long lower shadow also indicates that the bulls are willing to go on the defensive, if the index drop towards the immediate support. However, as the RSI is still hovering below the 50% threshold, the FKLI may need to undergo a further consolidation before it can climb towards the upside resistance or the 50-day SMA line. As long as the stop-loss stays intact, we are maintaining a positive trading bias.

We recommend that traders stay in long positions, which were initiated at 1,532 pts ie the closing level of 12 Nov. To protect the downside risks, an initial stop-loss has been set at 1,500 pts.

The immediate support remains at 1,512 pts (11 Nov’s low), with the lower support at 1,505 pts (5 Oct’s low). The first resistance remains at 1,537.50 pts – the high of 9 Nov – followed by 1,546.50 pts or the high of 3 Nov.

Source: RHB Securities Research - 23 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024