Hang Seng Index Futures: Bearish Posture Remains

rhboskres

Publish date: Tue, 23 Nov 2021, 08:56 AM

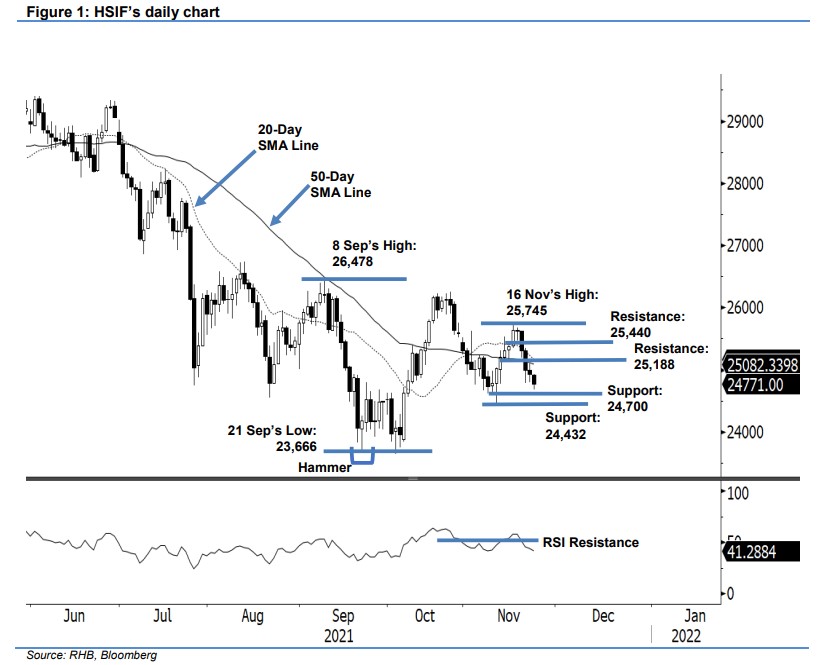

Maintain short positions. The HSIF continues to show price trend weakness, retreating 66 pts to the settle the day session at 24,923 pts on Monday. The index initially opened at 24,997 pts and rose to the 25,096-pt day high. It then reverted back to its southbound journey – reaching the 24,851-pt day low before the close. The HSIF fell another 152 pts during the evening session and last traded at 24,771 pts. The latest session reaffirmed that the 50-day SMA line is acting as a strong resistance. Upside movements in the coming sessions will be blocked by the selling pressure near the moving average line. Since turning downwards from 25,745 pts in mid-November, the index has been moving southwards on “lower highs and lower lows”. It will remain in a correction phase until it finds an interim base and forms a bullish reversal candlestick. For now, we maintain our negative trading bias.

We recommend traders maintain the short positions initiated at 24,892 pts, ie the closing level of 19 Nov’s evening session. For trading-risk management, an initial stop-loss mark is set at 25,500 pts.

The first support is marked at 24,700 pts and followed by subsequent support at 24,432 pts or 10 Nov’s low. The nearest resistance seen at 25,188 pts – 18 Nov’s low – and followed by 25,440 pts, ie 15 Nov’s high.

Source: RHB Securities Research - 23 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024