COMEX Gold: Negative Momentum Garners Pace

rhboskres

Publish date: Tue, 23 Nov 2021, 08:57 AM

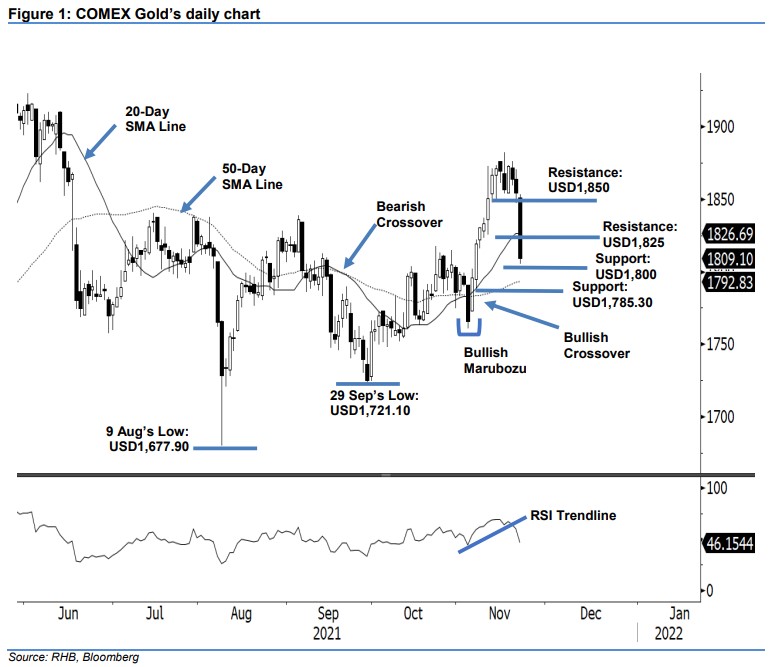

Trailing-stop level triggered; initiate short positions. The COMEX Gold experienced its worst session since 6 Aug yesterday, plunging USD45.20 to settle at USD1,809.10. It initially opened flat at USD1,850.70. After touching the USD1,853 session-high, the commodity moved sideways during the first half of the session. Strong sellng pressure emerged during the US trading hours, dragging it towards the USD1,805.30 session low before the close. Amidst the strong negative momentum, the COMEX Gold breached two support levels and is now eyeing to test the USD1,800 psychological mark. If the threshold gives way, expect further downside corrections. As the USD1,800 mark has been tested several times since 17 Jun, we expect the bulls to stage a technical rebound near this level. Nevertheless, since the trailing stop was triggered, we shift to a negative trading bias.

We closed out the long positions initiated at USD1,793.50 – the closing level of 4 Nov – after the USD1,845 trailing-stop was breached. Conversely, we initiate short positions at the closing level of 22 Nov, ie USD1,809.10. To manage the trading risks, the initial stop-loss threshold is set at USD1,835.

The immediate support is revised to the USD1,800 psychological level and followed by USD1,785.30, ie the low of 5 Nov. The first resistance is changed to USD1,825, followed by the USD1,850 whole number.

Source: RHB Securities Research - 23 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024