WTI Crude: Mild Rebound From the Immediate Support

rhboskres

Publish date: Tue, 23 Nov 2021, 08:58 AM

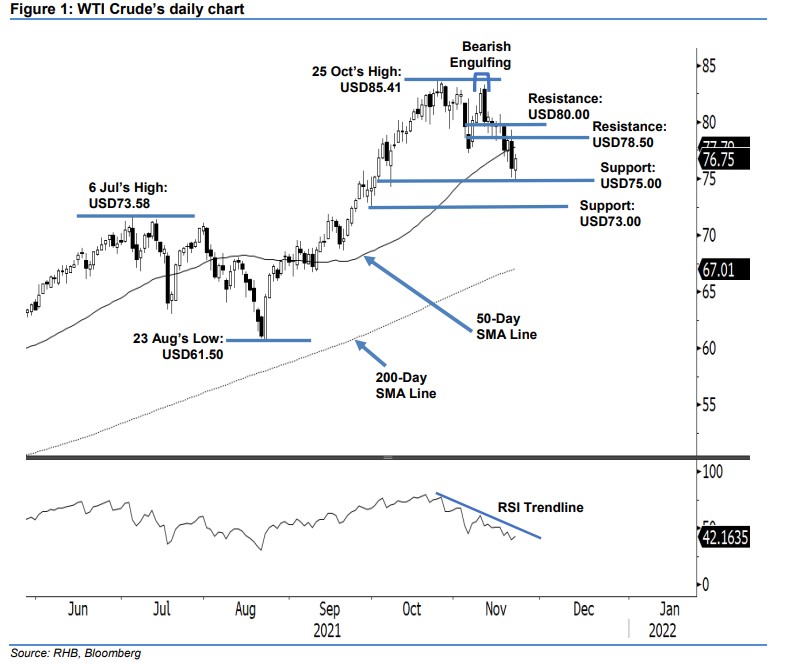

Maintain short positions. The WTI Crude has seen selling pressure tapering, rebounding USD0.81 to close higher at USD76.75. The commodity started off Monday’s session at USD75.75 and initially dipped to the USD74.76 day low. It then saw the bears taking a breather, with the WTI Crude progressing higher towards the USD77.16 intraday high before the close. Although the latest session saw a closing price higher than the opening ones, when compared with previous session, the commodity still booked a “lower low with lower high”. Hence, it is still premature to signal a price trend reversal. As long as the WTI Crude trades below the 50-day SMA line, the correction phase is deemed as not yet complete despite selling pressure seemingly subsiding. The commodity has to form a fresh “higher high” to indicate an end of the correction. As of now, we stick with a negative trading bias.

We recommend traders retain the short positions initiated at USD78.36, ie the closing level of 17 Nov. To mitigate the trading risks, the stop-loss mark is placed at USD80.00.

The immediate support level is revised to USD75.00, followed by the USD73.00 whole number. Conversely, the first resistance level remains at USD78.50 and is followed by the USD80.00 round number.

Source: RHB Securities Research - 23 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024