E-Mini Dow: Testing the Immediate Resistance

rhboskres

Publish date: Wed, 24 Nov 2021, 04:43 PM

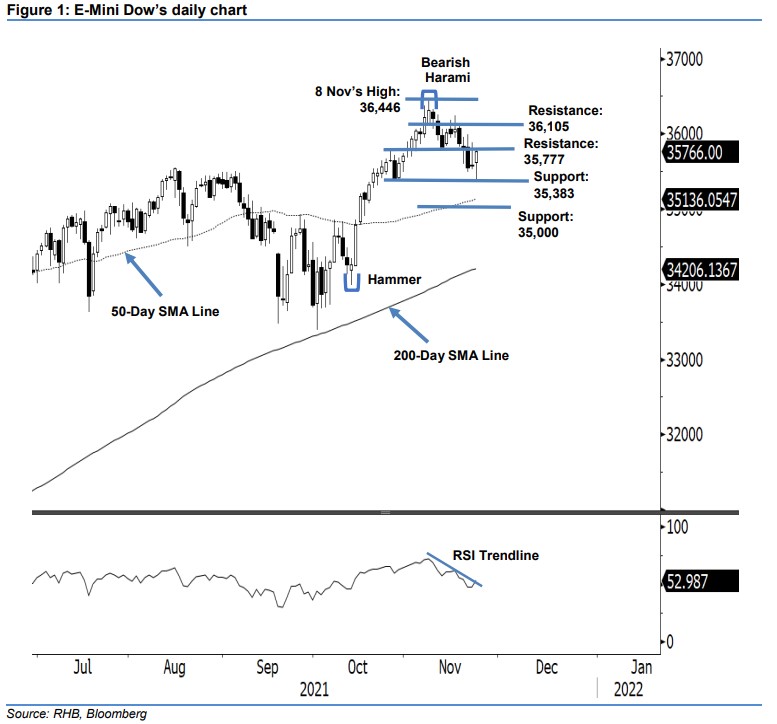

Maintain short positions. The E-Mini Dow experienced a session of two halves yesterday, rebounding 195 pts to settle stronger at 35,766 pts. The index initially opened at 35,620 pts and fell to the 35,370-pt session low. The tide changed during the US trading hours where it progressed higher to test the intraday high of 35,793 pts before the close. The latest session showed that strong buying interest has emerged at the 35,383-pt support level. Following a strong rebound, the E-Mini Dow has to break past the immediate resistance to form a fresh “higher high” bullish pattern and confirm that its trajectory has changed northwards. Meanwhile, we expect volatility to pick up before heading into the Thanksgiving holiday in the US – the bears may be prone to profit-taking near the resistance. We stick to our bearish trading bias until the stop-loss mark is breached.

Traders should retain the short positions initiated at 35,992 pts, ie the closing level of 10 Nov. For trading-risk management, the stop-loss threshold is set at 35,900 pts.

The immediate support is fixed at 35,383 pts – 27 Oct’s low – and is followed by the 35,000-pt round figure. The immediate resistance is sighted at 35,777 pts – 26 Oct’s high – and is followed by 36,105 pts, ie the high of 17 Nov.

Source: RHB Securities Research - 24 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024