WTI Crude: Bouncing Off From the Immediate Support

rhboskres

Publish date: Wed, 24 Nov 2021, 04:45 PM

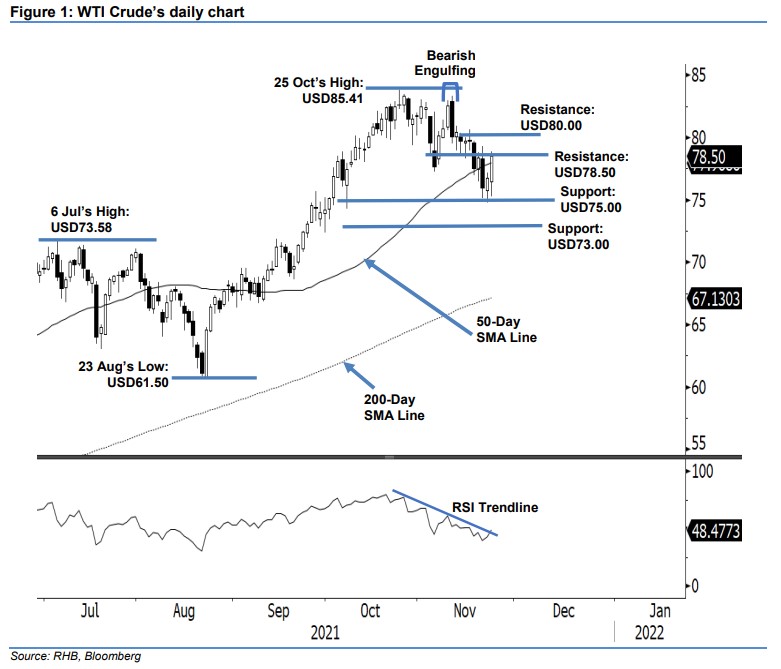

Maintain short positions. The WTI Crude staged a strong rebound from the support level, rising USD1.75 to settle at USD78.50. The commodity initially began at at USD76.46 and dipped to the USD75.30 day low. During the US trading hours, it surged to touch the USD78.86 day high before closing stronger at USD78.50. The latest price action suggests that the WTI Crude may have formed its interim base near the USD75.00 level. If the bullish momentum is sustained, it will climb above the USD78.50 resistance and stay above the 50-day SMA line. Meanwhile, we expect strong selling pressure to emerge between the USD78.50 and USD80.00 levels. At this stage, we are keeping to a negative trading bias until the stop-loss mark is triggered.

We advise traders to hold on to the short positions initiated at USD78.36, ie the closing level of 17 Nov. To limit the trading risks, the stop-loss threshold is fixed at USD80.00.

The immediate support level stays at USD75.00, followed by the USD73.00 whole number. On the upside, the nearest resistance is kept at USD78.50 and followed by the USD80.00 round number.

Source: RHB Securities Research - 24 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024