WTI Crude: Climbing Above the 50-Day SMA Line

rhboskres

Publish date: Thu, 25 Nov 2021, 06:33 PM

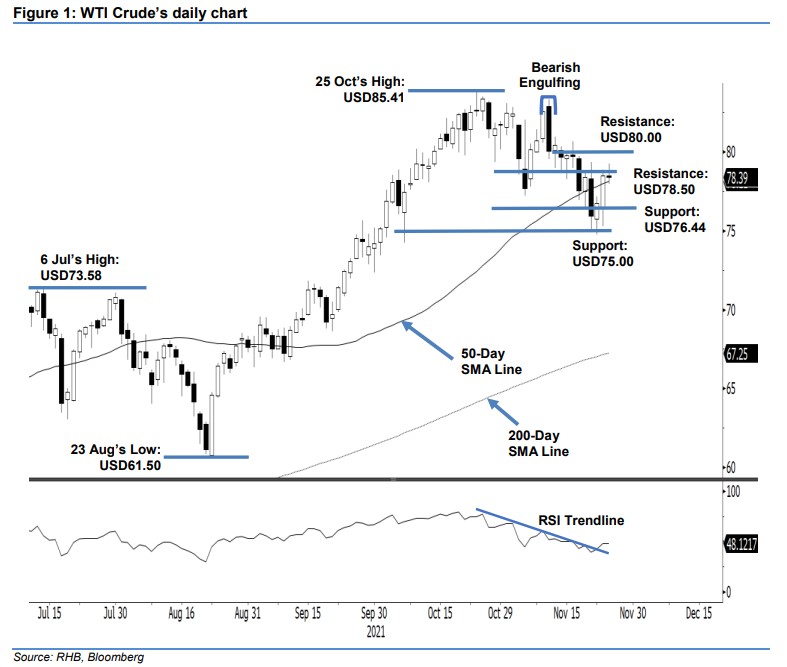

Maintain short positions. The WTI Crude attempted to cross above the immediate resistance on Wednesday. Despite a brief upside movement, it pulled back by a marginal USD0.11 to settle at USD78.39. The commodity initially opened at USD78.48 and retraced to the USD77.98 day low before climbing higher to test the USD79.23 day high. The bulls failed to sustain the intraday gains, which saw the WTI Crude pull back and close at USD78.39. As mentioned in our previous note, we expect selling pressure to persist in the USD78.50-80.00 range. The commodity may need further consolidation near the 50-day SMA line before launching a fresh attempt to challenge the upside resistance. We will stick to the negative trading bias until the stop-loss mark is breached.

Traders should keep to the short positions initiated at USD78.36, ie the closing level of 17 Nov. To mitigate the trading risks, the stop-loss threshold is placed at USD80.00.

The immediate support level is revised to USD76.44 – 18 Nov’s low – and is followed by the USD75.00 whole number. Conversely, the nearest resistance remains at USD78.50, followed by the USD80.00 round number.

Source: RHB Securities Research - 25 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024