Hang Seng Index Futures: Testing the Immediate Support

rhboskres

Publish date: Thu, 25 Nov 2021, 06:34 PM

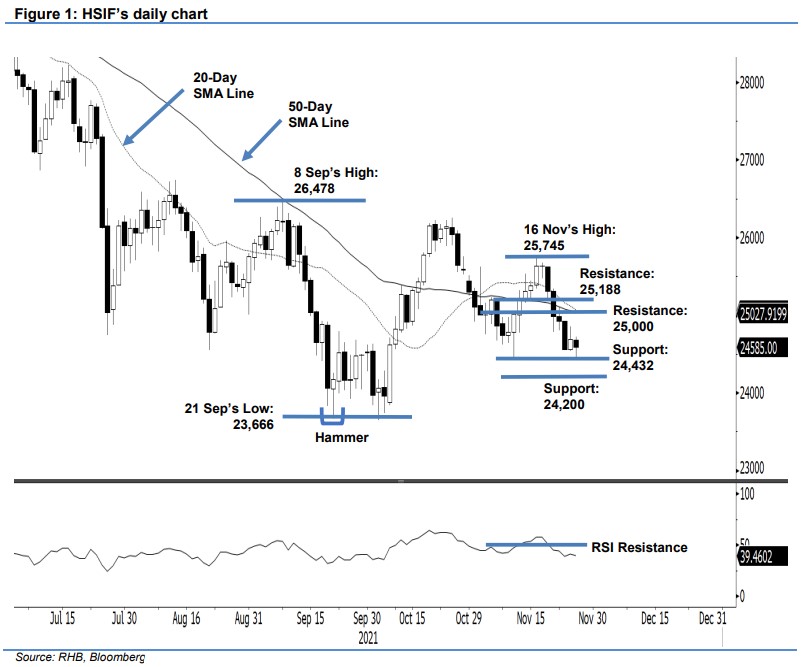

Maintain short positions. The HSIF staged a mild rebound yesterday, rising 124 pts to settle the day session at 24,688 pts. The index started the day session at 24,578 pts. After forming its intraday low at 24,537 pts, it climbed towards the 24,854-pt day high. Although it retraced in the afternoon, the HSIF managed to close at 24,688 pts and recorded a bullish candlestick. During the evening, the index bounced off from the 24,425-pt session low and last traded at 24,585 pts. The price action suggests that 24,432 pts is acting as a strong support. If the threshold gives way, the negative momentum may accelerate towards the 24,200-pt level. Meanwhile, the HSIF may consolidate along the immediate support. Despite the selling pressure failing to follow through during the latest session, we still stick with our negative trading bias.

Traders should retain the short positions initiated at 24,892 pts, ie the closing level of 19 Nov’s evening session. For trading-risk management, the stop-loss mark is fixed at 25,188 pts.

The nearest support stays at 24,432 pts – 10 Nov’s low – and is followed by the subsequent support at 24,200 pts. The immediate resistance is pegged to the 25,000-pt round figure and followed by 25,188 pts, ie the low of 18 Nov.

Source: RHB Securities Research - 25 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024