COMEX Gold: Struggling Near the 50-Day SMA Line

rhboskres

Publish date: Thu, 25 Nov 2021, 06:36 PM

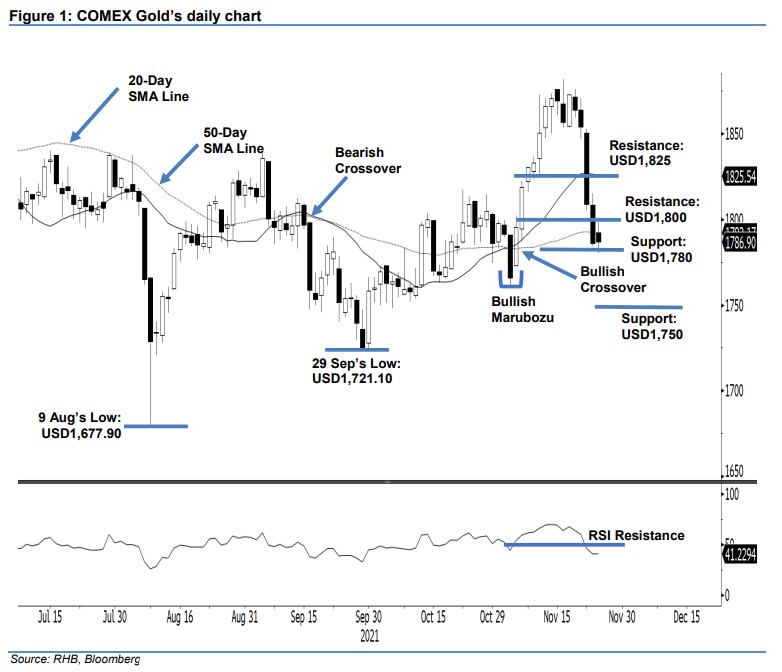

Maintain short positions. After experiencing a steep correction yesterday, the COMEX Gold saw selling pressure taper, as it rebounded by a marginal USD0.60 to settle at USD1,786.90. The commodity initially opened at USD1,792.30. It then whipsawed between USD1,798.80 and USD1,780.20 before closing at USD1,786.90. The latest session saw the yellow metal attempting to search for an interim base near the 50-day SMA line. If it manages to climb above the USD1,800 psychological level, we may see the bullish momentum strengthening. Otherwise, the COMEX Gold will still see the downside risk looming. If the immediate support – or USD1,780 level – gives way, the commodity could correct towards the lower support at USD1,750. As of now, we keep to our negative trading bias.

We advise traders retain the short positions iniitated at USD1,809, or the closing level of 22 Nov. To protect the trading risks, the stop-loss threshold is placed at USD1,830.

The immediate support remains at USD1,780 and is followed by the USD1,750 whole number. Meanwhile, the immediate resistance is pegged at the USD1,800 round number, followed by the USD1,825 threshold.

Source: RHB Securities Research - 25 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024