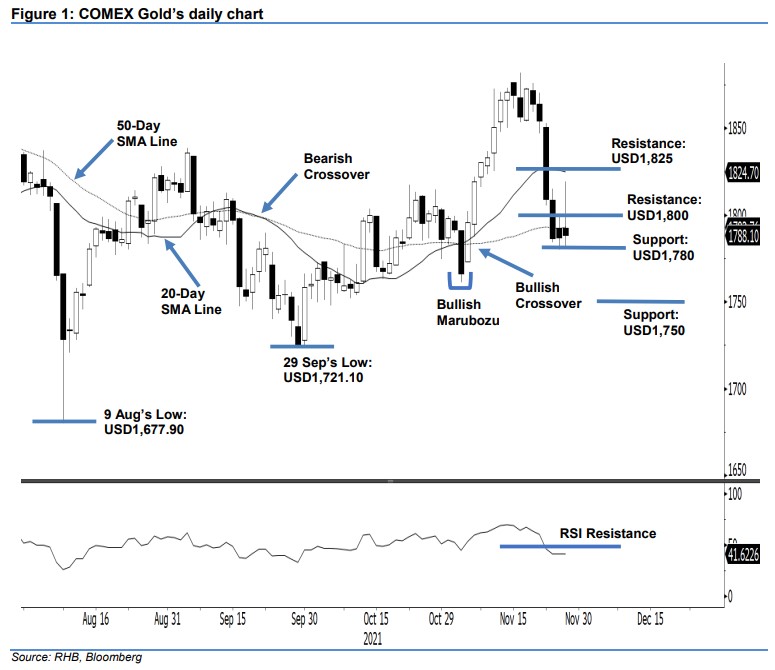

COMEX Gold: Hovering Near the 50-Day SMA Line

rhboskres

Publish date: Mon, 29 Nov 2021, 08:44 AM

Maintain short positions. The COMEX Gold tried to stage a rebound from the 50-day SMA line last Friday despite recording a smaller USD1.20 gain to settle at USD1,788.10. It initially started at USD1,792.30 and then climbed higher on strong buying interest, touching the USD1,819.30 session high. However, strong profit-taking emerged during the US trading hours, where the precious metal pared its intraday gains and retraced to the USD1,781.60 session low before the close. The long upper shadow indicates strong selling pressure persisting at the USD1,800 level. As long as the COMEX Gold manages to retain its position near the 50-day SMA line, the bulls may stage another attempt to re-test the psychological level in the near future. Meanwhile, breaching below the immediate support will start a fresh correction leg. We keep to our negative trading bias for now.

We recommend traders hold on to short positions iniitated at USD1,809, ie the closing level of 22 Nov. To manage the trading risks, the stop-loss threshold is set at USD1,830.

The immediate support is marked at USD1,780 and followed by the USD1,750 whole number. On the upside, the immediate resistance stays at the USD1,800 round number, followed by the USD1,825 threshold.

Source: RHB Securities Research - 29 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024