Hang Seng Index Futures: Selling Pressure Accelerates

rhboskres

Publish date: Mon, 29 Nov 2021, 08:44 AM

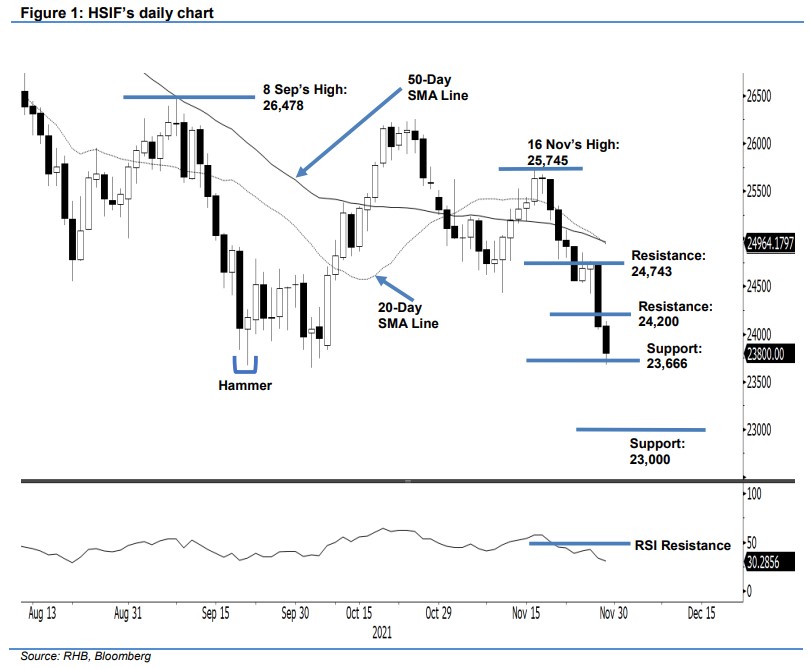

Maintain short positions. After falling below 25,000 pts, the HSIF saw selling pressure accelerate last Friday as it plunged 664 pts to settle the day session at 24,082 pts. The index initially gapped down in the morning, beginning at 24,470 pts. It dived to the 24,044-pt day low before closing weaker at 24,082 pts. During the evening session, the selling pressure continued, which saw the HSIF shed 282 pts – it last traded at 23,800 pts. The latest session saw the index continuing its downward movement by printing a fresh “lower low”. As long as it stays below 25,000 pts, the correction should continue until it finds an interim support with long lower shadow or bullish reversal candlestick. At this stage, the bears are testing the September low of 23,666 pts. Breaching this will send the HSIF towards the next psychological support at 23,000 pts. For now, we keep to our negative trading bias.

Traders are advised to retain the short positions initiated at 24,892 pts, or the closing level of 19 Nov’s evening session. To mitigate the trading risks, the stop-loss point is revised to 25,000 pts from 25,188 pts.

The immediate support has been changed to 23,666 pts – 21 Sep’s low – and is followed by the subsequent support at 23,000 pts. The immediate resistance is revised to the 24,200-pt whole number and is followed by 24,743 pts, ie the high of 26 Nov.

Source: RHB Securities Research - 29 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024