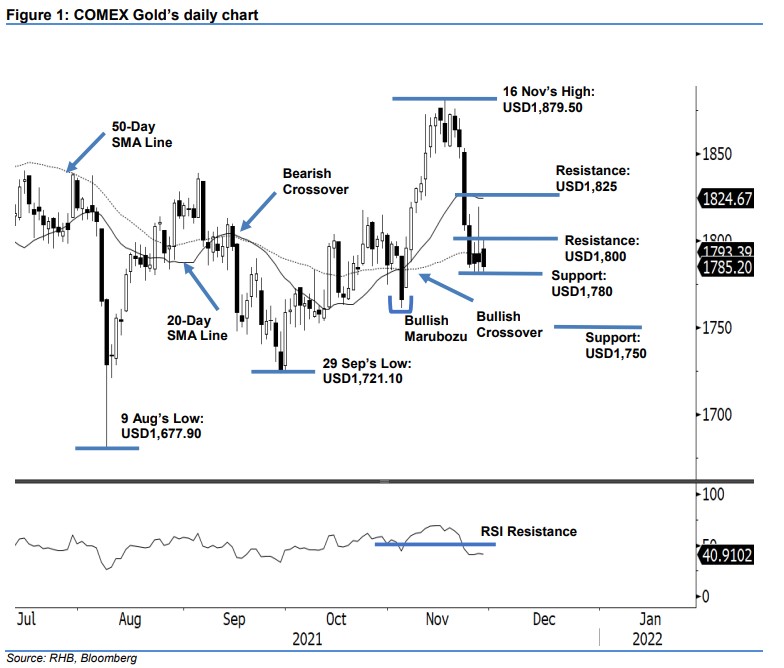

COMEX Gold: Consolidating Near the 50-Day SMA Line

rhboskres

Publish date: Tue, 30 Nov 2021, 08:40 AM

Maintain short positions. After failing to stage a rebound, the COMEX Gold resort to moving sideways along the 50-day SMA line. It retraced USD2.90 to settle at USD1,785.20. The commodity started off Monday’s session at USD1,795.20 and rose to test the USD1,801.50 intraday high during the European trading hours. However, it retreated to the USD1,782 day low before the close. Despite the COMEX Gold printing three consecutive bearish candlesticks, it managed to stay on course with the horizontal movement – trading in the range of USD1,800 and USD1,780. Premised on the RSI still trading below the 50% threshold, we believe the commodity will continue consolidating until it breaks out from the sideways zone. While the yellow metal is consolidating, we hold on to our negative trading bias for now.

Traders are advised to retain the short positions iniitated at USD1,809, ie the closing level of 22 Nov. For trading-risk management, the stop-loss threshold is fixed at USD1,830.

The immediate support is marked at USD1,780 and followed by the USD1,750 whole number. On the other hand, the immediate resistance remains at the USD1,800 round number, followed by the USD1,825 threshold.

Source: RHB Securities Research - 30 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024