FCPO: Momentum Remains Weak

rhboskres

Publish date: Tue, 30 Nov 2021, 08:46 AM

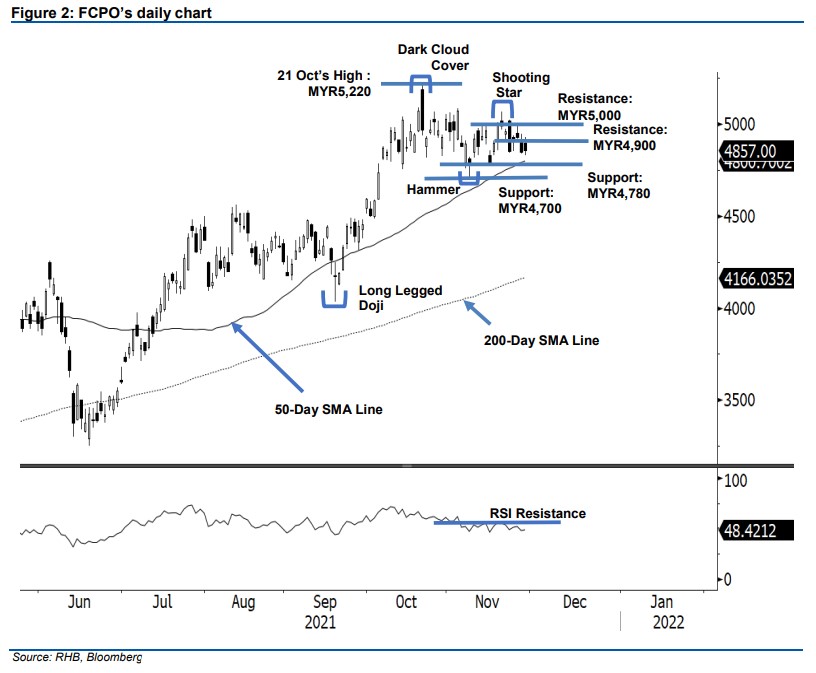

Maintain short positions. Despite the FCPO staging a strong intraday rebound on Monday, its gains were reduced to a mere MYR9 as it settled at MYR4,858 – the upside movement was blocked by the resistance of MYR4,900. The commodity initially gapped up and opened at MYR4,900, rising higher during the early session to test the MYR4,931 session’s high. However, the bullish momentum failed to sustain, and was followed by strong profit taking near the MYR4,900 level, dragging the index to reach the session’s low of MYR4,832 before the close. The latest session saw the commodity print a fresh “lower high” bearish pattern. It also reaffirmed that sentiment remains cautious as the bears tend to take profits on a rebound. As long as the commodity continues to chart “lower highs with lower lows”, the risk of a downward correction is imminent. Meanwhile, the bulls need to overcome the MYR4,900 resistance to chart a fresh “higher high” before testing the MYR5,000 psychological mark. Since the RSI is still trending below the 50% threshold – suggesting weak momentum ahead – we continue to hold on to our negative trading bias.

We recommend traders to maintain the short positions initiated at MYR4,849, or the closing level of 26 Nov. To manage the trading risks, the initial stop-loss is placed at MYR5,000.

The immediate support has been changed to MYR4,780 – 16 Nov’s low – followed by MYR4,700. On the upside, the nearest resistance remains at MYR4,900, followed by the MYR5,000 round figure.

Source: RHB Securities Research - 30 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024