COMEX Gold: Negative Momentum Picking Up Pace

rhboskres

Publish date: Wed, 01 Dec 2021, 05:21 PM

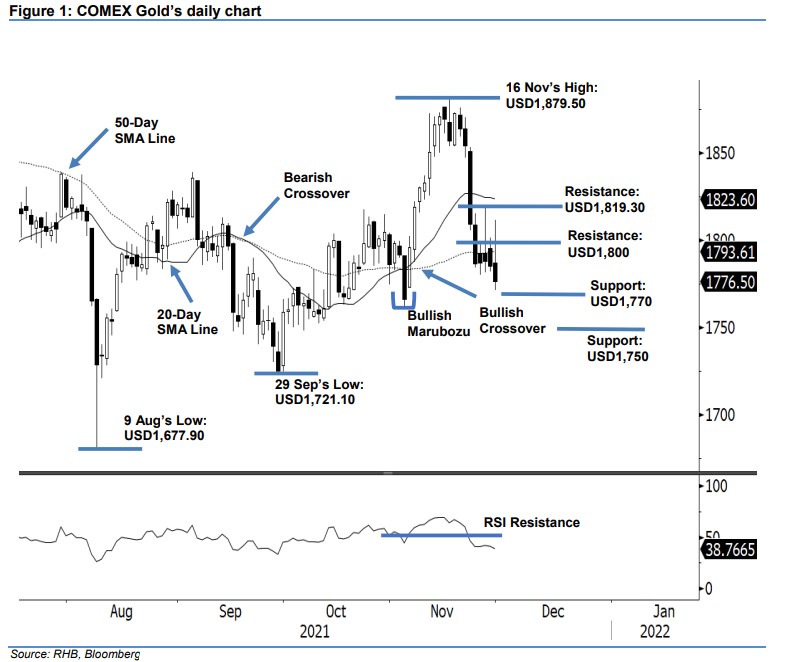

Maintain short positions. The COMEX Gold breached its support level and declined, despite a strong intraday rebound. The commodity started off Tuesday’s session at USD1,786.90, and rose to a high of USD1,811.40 during the US trading session. However, strong profit-taking dragged it to the session’s low of USD1,771.20 ahead of the close. With negative momentum regaining strength, the commodity breached the support and printed a fresh “lower low”. It may see follow through momentum to test the USD1,770 level, followed by USD1,750. For now, the 50-day SMA line will act as a resistance. The correction will continue until the yellow metal able is to establish its interim support. We retain our negative trading bias for now.

Traders are recommended to keep the short positions initiated at USD1,809 or the closing level of 22 Nov. For risk management, the stop-loss threshold is adjusted to USD1,825 from USD1,830.

The immediate support has been revised to USD1,770, followed by USD1,750. On the upside, the immediate resistance is pegged at the USD1,800 round number, followed by USD1,819.30 (26 Nov’s high).

Source: RHB Securities Research - 1 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024