Hang Seng Index Futures: Testing the Immediate Resistance

rhboskres

Publish date: Thu, 02 Dec 2021, 05:40 PM

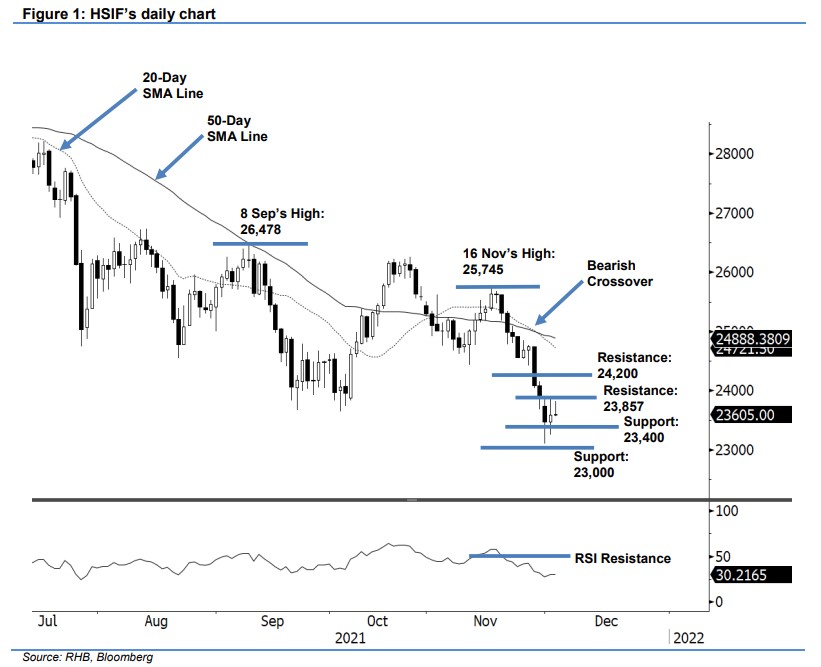

Maintain short positions. The HSIF saw selling pressure taper on Wednesday, rebounding 117 pts to settle the day session at 23,592 pts. The index began yesterday’s day session weaker at 23,509 pts. After touching the 23,440-pt day low, it rebounded to test the 23,871-pt day high. Mild profit-taking in the afternoon saw the index retrace to close at 23,592 pts. In the evening session, after whipsaw movement, the index last traded at 23,605 pts. Although the index attempted to stage a rebound, the effort was blocked by the immediate resistance level at 23,857 pts. As such, the index has not been able to form a “higher high” to confirm a change of direction. In the event that it crosses the immediate resistance, we expect strong selling pressure at the 24,200-pt level. At this stage, it is still too premature to conclude that the downward movement has ended. Hence, we keep our negative trading bias.

We advise traders to stick to the short positions initiated at 24,892 pts or the closing level of 19 Nov’s evening session. For risk management, the trailing-stop is placed at 24,200 pts.

The immediate support is marked at 23,400 pts, followed by the 23,000-pt round number. On the upside, the immediate resistance stays at 23,857 pts – 30 Nov’s high – followed by 24,200 pts.

Source: RHB Securities Research - 2 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024