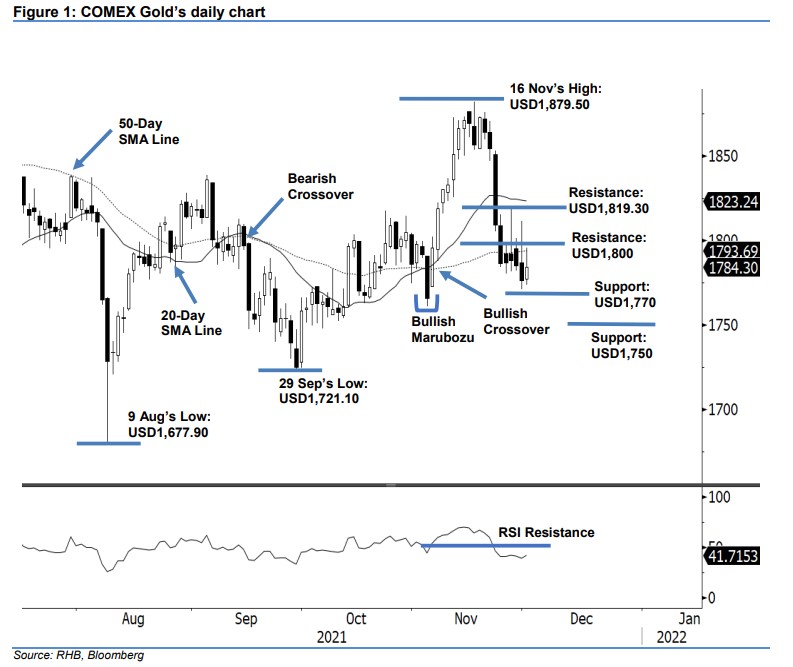

COMEX Gold: Testing the 50-Day SMA Line

rhboskres

Publish date: Thu, 02 Dec 2021, 05:40 PM

Maintain short positions. The COMEX Gold attempted to cross the 50-day SMA line overhead resistance level, rising USD7.80 to close stronger at USD1,784.30. On Wednesday, the commodity began the session at USD1,777.40. After forming the intraday low at USD1,773.70, it climbed to test the day’s high of USD1,795.70. While the bears seized the day’s high to take profit, the bulls staged a second attempt to breach the day’s high during the US trading session. Momentum fizzled as the commodity retraced to close at USD1,784.30. The 50- day SMA line still poses strong resistance. This, coupled with strong selling pressure expected at USD1,800, will limit upside movement. Meanwhile, a breach of the immediate support at USD1,770 would attract further selling pressure. We believe the downside risk remains, and hold on to our negative trading bias.

Traders should retain the short positions initiated at USD1,809 or the closing level of 22 Nov. To mitigate trading risks, the stop-loss threshold is placed at USD1,825.

The immediate support is marked at USD1,770, followed by USD1,750. Conversely, the immediate resistance remains at the USD1,800 round number, followed by USD1,819.30 or the high of 26 Nov.

Source: RHB Securities Research - 2 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024