Hang Seng Index Futures : Consolidates Sideways

rhboskres

Publish date: Fri, 03 Dec 2021, 04:45 PM

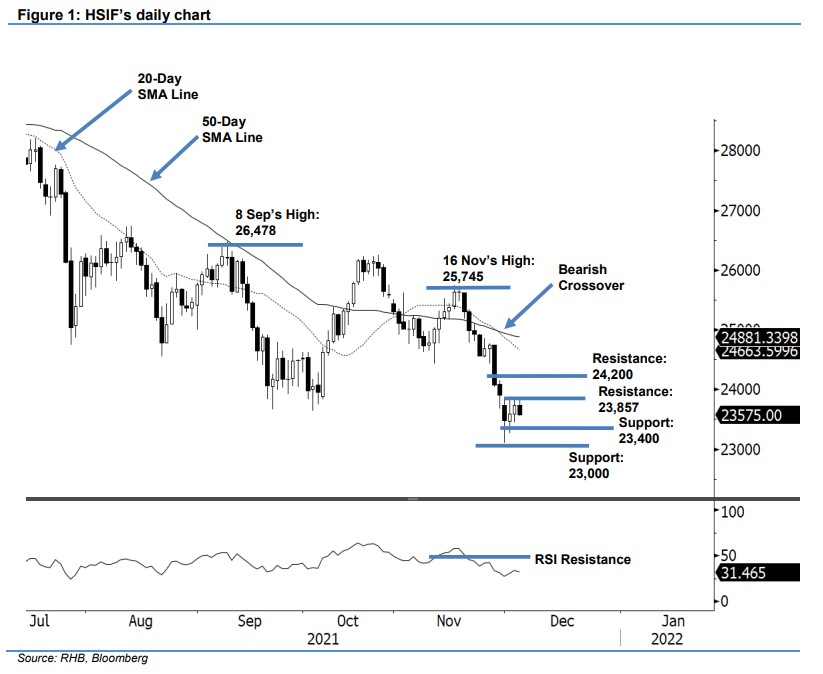

Maintain short positions. The HSIF consolidated above the immediate support yesterday, adding 148 pts to settle the day session stronger at 23,740 pts. The index began at 23,490 pts before rising to the 23,801-pt day high. It then whipsawed sideways and closed at 23,740 pts. During the evening session, despite climbing further to test the 23,847-pt session high, the HSIF retraced and last traded at 23,575 pts. Underpinning the renewed momentum, the bulls are now looking to re-test the 23,857-pt immediate resistance. Breaching this threshold may lift the index back to the 24,000-pt level, improving market sentiment. Yet, we retain our view that the 24,200-pt level still poses a strong resistance and will limit further upside movements. Coupled with the RSI still trending below the 50% threshold, the HSIF is unlikely to see a bullish breakout in the immediate session. As such, we keep to our negative trading bias.

Traders should hold on to the short positions initiated at 24,892 pts, ie the closing level of 19 Nov’s evening session. To manage the trading risks, the trailing-stop threshold is set at 24,200 pts.

The immediate support stays at 23,400 pts, followed by the 23,000-pt round number. Conversely, the immediate resistance remains at 23,857 pts – 30 Nov’s high – and is followed by 24,200 pts.

Source: RHB Securities Research - 3 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024