WTI Crude: Bouncing Off Above the Immediate Support

rhboskres

Publish date: Fri, 03 Dec 2021, 04:47 PM

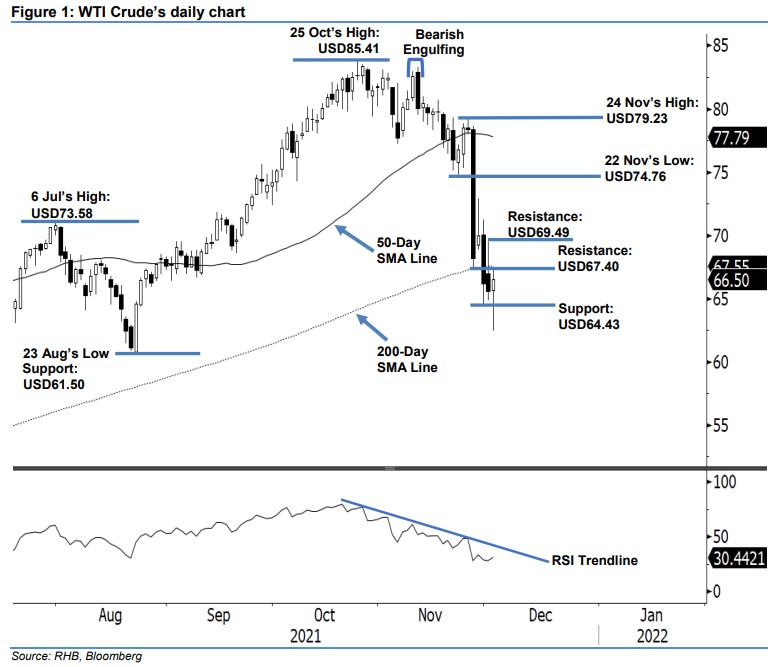

Maintain short positions. The WTI Crude pared down its intraday losses yesterday to close moderately positive – it bounced off its immediate support level and touched the 200-day average line at the intraday high. The black gold settled USD0.93 higher at USD66.50. It opened at USD65.63 and gradually rose higher, which saw it hit the USD67.49 day high during the European trading session. Selling pressure then emerged to drag the WTI Crude southwards to touch the intraday low of USD62.43, though it was shortlived. Buying pressure re-emerged to bounce off positively strongly to close above the opening at USD66.50. The latest white body candlestick with long lower shadow – which failed to breach the immediate support level – is indicating the re-emergence of buying pressure near the immediate support level of USD64.43. We expect the positive momentum to continue towards the USD67.40 resistance in the immediate term. However, bearish momentum remains intact in the medium term – unless the newly initroduced trailing-stop is triggered. With that, we stick to our bearish trading bias.

Traders should maintain the short positions initiated at USD78.36 or the closing level of 17 Nov. To control the trading risks, the initital trailing-stop threshold is introduced at the USD69.49 resistance. The immediate support remains at USD64.43 – 30 Nov’s low – and followed by USD61.50, which was 23 Aug’s low. The nearest resistance is set at USD67.40 – 26 Nov’s low – and followed by USD69.49, ie 1 Dec’s high.

Source: RHB Securities Research - 3 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024