COMEX Gold: Negative Momentum Picks Up Again

rhboskres

Publish date: Fri, 03 Dec 2021, 04:48 PM

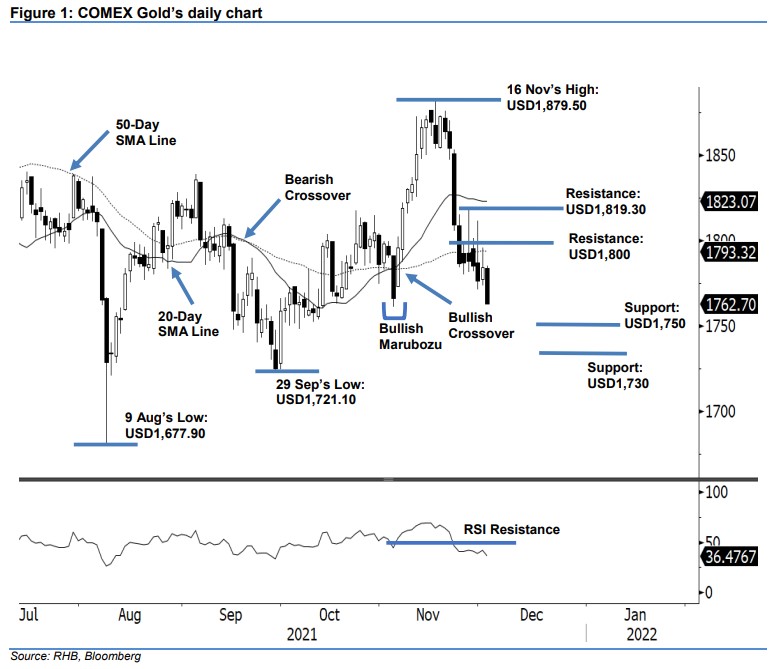

Maintain short positions. The COMEX Gold resumed its downwards movement yesterday, descending USD21.60 to close weaker at USD1,762.70. The commodity started off at USD1,783.80 and briefly touched the USD1,785.20 day high. It then progressed lower and reached USD1,762.20 before the close. With the bearish candlestick, the bears are now back in control. If the negative momentum follows through, it may nullify the Bullish Marubozu that formed on 4 Nov and drop to the USD1,750 level. Conversely, if the COMEX Gold stages a technical rebound, USD1,800 will act as a strong psychological barrier. At this stage, the bearish structure has been strengthened and we expect further corrections. Hence, we stay with our negative trading bias.

We adivse traders to keep the short positions initiated at USD1,809, ie the closing level of 22 Nov. To limit the trading risks, the stop-loss threshold is fixed at USD1,825.

The immediate support is revised to USD1,750 and followed by the USD1,730 whole number. Meanwhile, the immediate resistance remains pinned to the USD1,800 round number and followed by USD1,819.30, or the high of 26 Nov.

Source: RHB Securities Research - 3 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024