Hang Seng Index Futures: Downside Risk Persists

rhboskres

Publish date: Mon, 06 Dec 2021, 08:36 AM

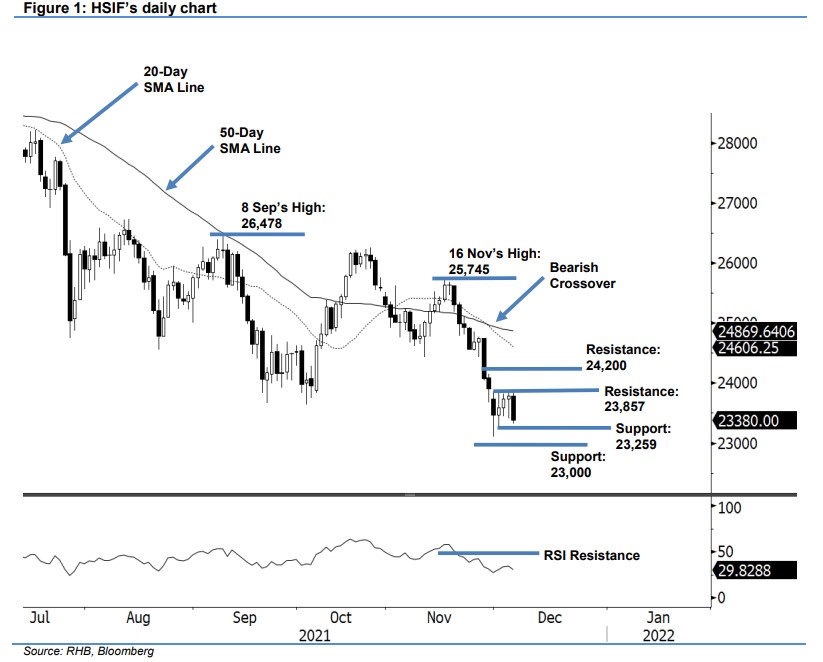

Maintain short positions. The HSIF experienced a session of two halves last Friday. Initially, it started off the day session at 23,619 pts and closed higher at 23,785 pts after testing the day’s high of 23,845 pts. However, in the evening session, the index gave up all its gains and retreated 405 pts to close at 23,380 pts – forming a long bearish candlestick. With the negative price action, the sentiment will remain risk-off in the coming sessions. The RSI also weakened to below the 30% level and is pointing downwards, suggesting a follow through of negative momentum to test 23,259 pts, followed by the 23,000-pt level. At this stage, it is very likely to see another leg of correction. Hence, we still retain our negative trading bias.

Traders are advised to keep the short positions initiated at 24,892 pts, ie the closing level of 19 Nov’s evening session. To minimise the trading risks, the trailing-stop threshold is fixed at 24,200 pts.

The immediate support is revised lower to 23,259 pts (1 Dec’s low), followed by the 23,000-pt round number. Meanwhile, the immediate resistance stays at 23,857 pts – 30 Nov’s high – followed by 24,200 pts.

Source: RHB Securities Research - 6 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024