Hang Seng Index Futures: Looking to Test the Resistance

rhboskres

Publish date: Tue, 07 Dec 2021, 08:31 AM

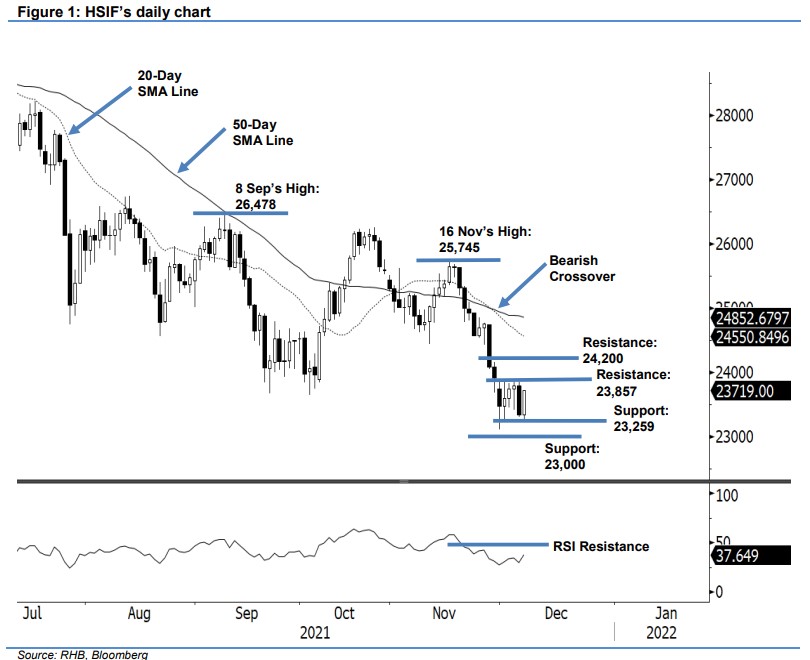

Maintain short positions. The HSIF continued its range-bound movement yesterday. It started off weaker at 23,405 pts and ended the day session lower at 23,332 pts, after testing the low of 23,302 pts. However, the tide changed during the evening session, with the index rebounding 387 pts to close at 23,719 pts. Although there was brief bullish momentum during the evening session, the index still traded below the 23,857-pt immediate resistance – hence, a “higher high” has not been formed yet. Nevertheless, in the event that momentum picks up, and the threshold is breached, the index may climb to test the higher resistance at 24,200 pts. We stick to our negative trading bias until the trailing-stop is triggered.

Traders should hold on to the short positions initiated at 24,892 pts, or the closing level of 19 Nov’s evening session. To mitigate trading risks, the trailing-stop threshold is set at 24,200 pts.

The immediate support is marked at 23,259 pts (1 Dec’s low), followed by the 23,000-pt round number. Conversely, the immediate resistance remains unchanged at 23,857 pts – 30 Nov’s high – followed by 24,200 pts.

Source: RHB Securities Research - 7 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024