FKLI: Tumbles Below 1,500-Pt Mark

rhboskres

Publish date: Tue, 07 Dec 2021, 08:40 AM

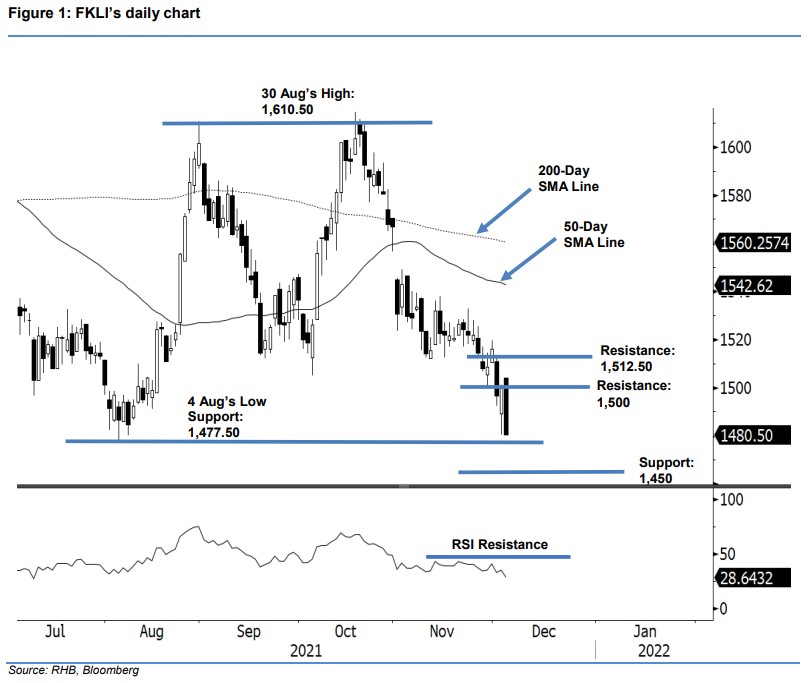

Maintain short positions. Yesterday, the FKLI plunged by 19.5 pts to close at 1,480.50 pts, after failing to stay above the 1,500-pt psychological mark. The benchmark index opened at 1,504 pts. Selling pressure emerged thereafter, and pulled the index down throughout the session to its day’s low of 1,480 pts before the close. It then rose 2 pts in the after-hours trading session and last traded at 1,482.50 pts. Monday’s session has erased the gains from previous day, and the correction is now poised to be extended to test the 1,477.50-pt level. Breaching the support would see the bears pulling it down towards 1,450 pts. Meanwhile, the 1,500-pt level has become a strong support-turned-resistance. Traders can expect strong selling pressure to kick in at this crucial level, blocking the upside movement. With the bears back in the driver’s seat, we will maintain a negative trading bias.

Traders should keep to short positions, which were initiated at 1,496.50 pts or the close of 1 Dec. To manage trading risks, the stop-loss is fixed at 1,517 pts.

The immediate support has been revised to 1,477.50 pts (4 Aug’s low), followed by 1,450 pts. The immediate resistance has been set at 1,500 pts, then 1,512.50 pts or the high of 1 Dec.

Source: RHB Securities Research - 7 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024