COMEX Gold : Still Moving Sideways for Consolidation

rhboskres

Publish date: Wed, 08 Dec 2021, 05:55 PM

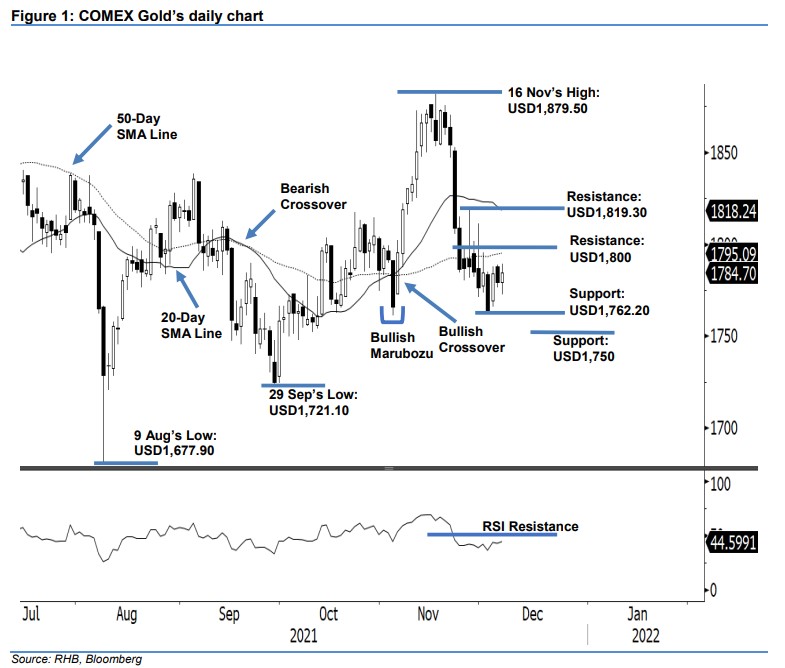

Maintain short positions. The COMEX Gold continued its sideways movement below the 50-day SMA line, rising USD5.20 to settle at USD1,784.70. The commodity started yesterday’s session at USD1,779.50. It fell to the session’s low of USD1,772.40, but strong buying interest during the US trading session lifted it to test the USD1,789.30 session high before the close. We observed that the RSI is still trending below the 50% threshold, suggesting that momentum will continue to be weak in the upcoming sessions. Meanwhile, the 20-day SMA line is heading lower, and this may increase selling pressure on the yellow metal. If the USD1,762.20 support gives way, we expect strong negative momentum to emerge. For now, we retain our negative trading bias.

Traders should stick with the short positions initiated at USD1,809, or the closing level of 22 Nov. To mitigate trading risks, the stop-loss threshold is set at USD1,825.

The immediate support remains at USD1,762.20 (2 Dec’s low), followed by USD1,750. The immediate resistance stays at the USD1,800 round number, followed by USD1,819.30, or the high of 26 Nov.

Source: RHB Securities Research - 8 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024