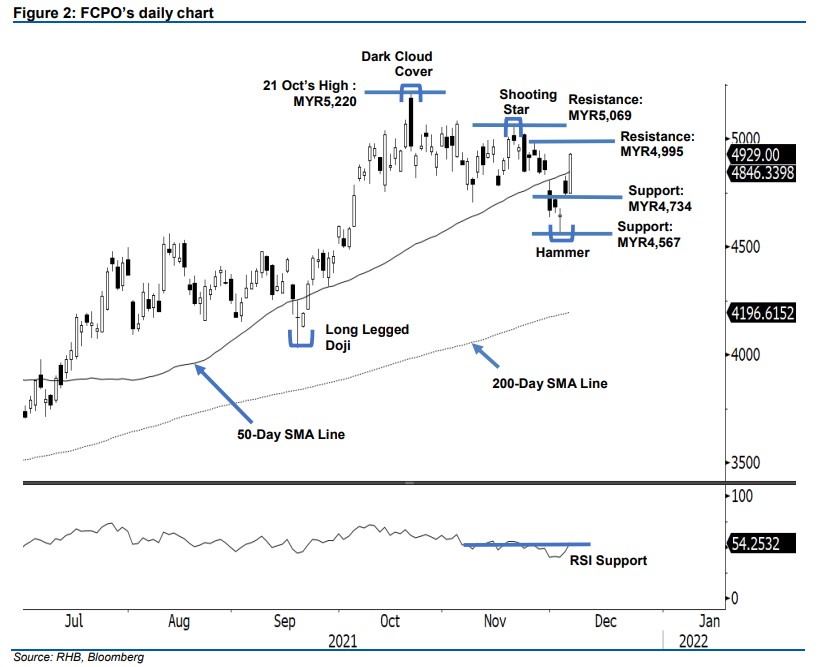

FCPO: Moving Back Above The 50-Day SMA Line

rhboskres

Publish date: Wed, 08 Dec 2021, 05:57 PM

Trailing-stop triggered; initiate long positions. Bullish momentum on the FCPO picked up yesterday, and lifted it to reclaim the 50-day SMA line. The commodity opened at MYR4,750, then climbed towards the day’s high of MYR4,923 before closing at MYR4,929. The strong momentum broke past the previous resistance of MYR4,832 and led the commodity to close above the 50-day SMA line. With the latest price action, the bulls have wrested control of the market. With the RSI crossing above the 50% threshold, expect the follow-through momentum to test the MYR5,000 psychological level or, at least, the MYR4,995 resistance. Since the commodity is signalling a bullish set-up, coupled with the trailing-stop being breached, we switch over to a positive trading bias now.

We closed out the short positions initiated at MYR4,849 or the closing level of 26 Nov, after the trailing-stop of MYR4,840 was breached. Conversely, we initiate long positions at the closing level of 7 Dec, or MYR4,929. To protect the downside risks, the initial stop-loss is at MYR4,700.

The immediate support remains at MYR4,734 (6 Dec’s low), followed by MYR4,567 (2 Dec’s low). Towards the upside, the nearest resistance has been revised to MYR4,995 or the high of 25 Nov, followed by MYR5,069 (19 Nov’s high).

Source: RHB Securities Research - 8 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024