WTI Crude: Bullish Momentum Continues

rhboskres

Publish date: Thu, 09 Dec 2021, 04:55 PM

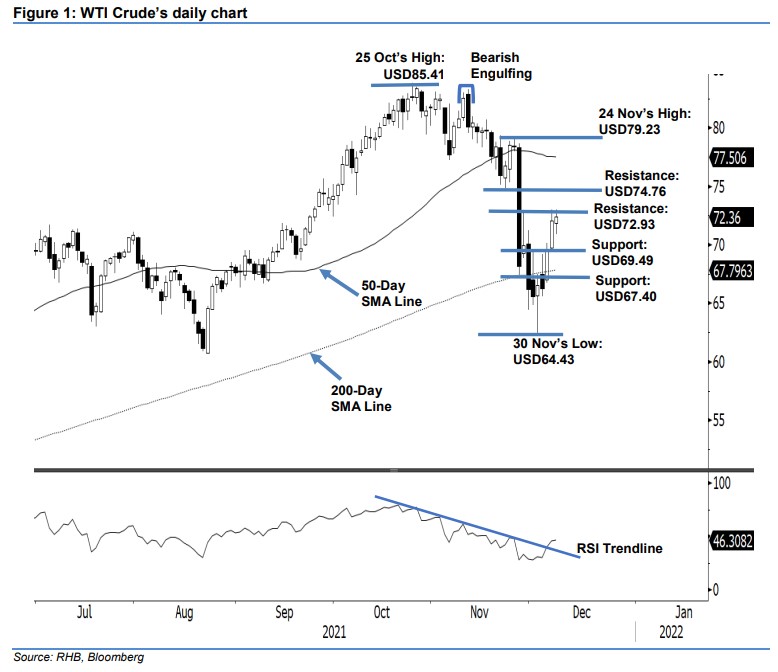

Maintain long positions. The WTI Crude extended its bullish momentum for the third consecutive session, rising USD0.31 to settle at USD72.36. It started Wednesday’s session at USD71.86. The commodity initially saw some mild profit-taking, and dipped to the session’s low of USD70.91. However, strong buying interest emerged during the US trading session, lifting the commodity towards the session’s high of USD73.00 before the close. With the latest price action, the bulls appear to still be in control. With the RSI breaching the trendline and improving to 46%, bullish momentum is growing. As long as the commodity continues to trade above the 200-day SMA line, it may move higher to test the upside resistance. Premised on this, we retain our positive trading bias.

We recommend traders maintain the long positions initiated at USD72.05 or the closing level of 7 Dec. To manage downside risks, the initial stop-loss is placed at USD67.40.

The immediate support is marked at USD69.49 (1 Dec’s high), followed by USD67.40 or the low of 26 Nov. The nearest resistance is set at USD72.93 (29 Nov’s high), followed by USD74.76, or 22 Nov’s low.

Source: RHB Securities Research - 9 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024