COMEX Gold: Momentum Remains Weak

rhboskres

Publish date: Thu, 09 Dec 2021, 04:57 PM

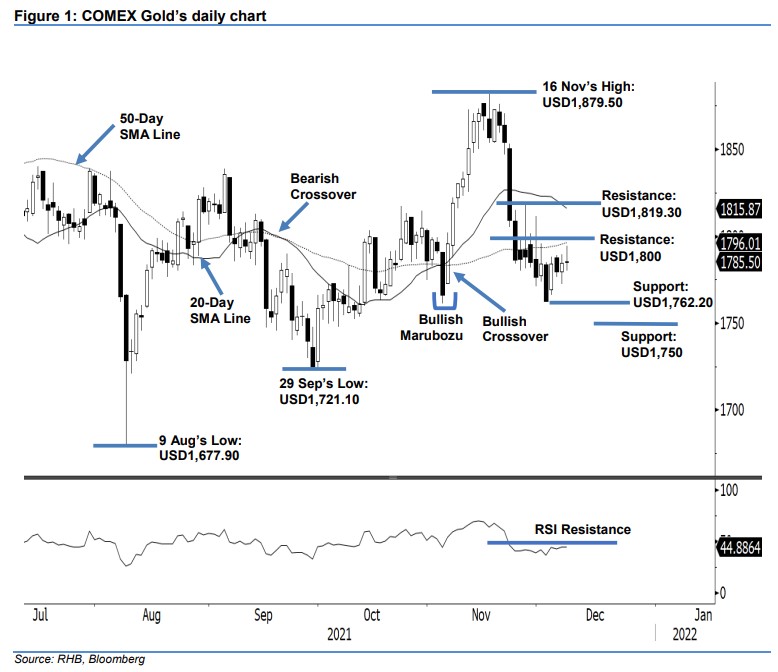

Maintain short positions. The COMEX Gold attempted to break out from its sideways movement, climbing USD0.80 to settle marginally higher at USD1,785.50. The commodity started yesterday’s session at USD1,785.10 and rose to the day’s high of USD1,794.30. However, the bullish momentum was short-lived, and profit-taking brought it down to the day’s low of USD1,780.10 before the close. Despite the attempt to stage a bullish breakout, momentum remains weak, and the index will continue moving sideways. As the 20-day SMA line continues to drift lower, selling pressure is increasing – hence, the risk of downside correction has increased. For now, the upside movement will remain within the USD1,800 psychological barrier. We hold on to our negative trading bias until the momentum reverses to breach the stop-loss.

Traders are recommended to stay with the short positions initiated at USD1,809, or the closing level of 22 Nov. To manage trading risks, the stop-loss threshold is placed at USD1,825.

The immediate support is fixed at USD1,762.20 (2 Dec’s low), followed by USD1,750. The immediate resistance is pegged at the USD1,800 round number, followed by USD1,819.30, or the high of 26 Nov.

Source: RHB Securities Research - 9 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024