FKLI: Capped By 1,500-Pt Resistance

rhboskres

Publish date: Thu, 09 Dec 2021, 04:59 PM

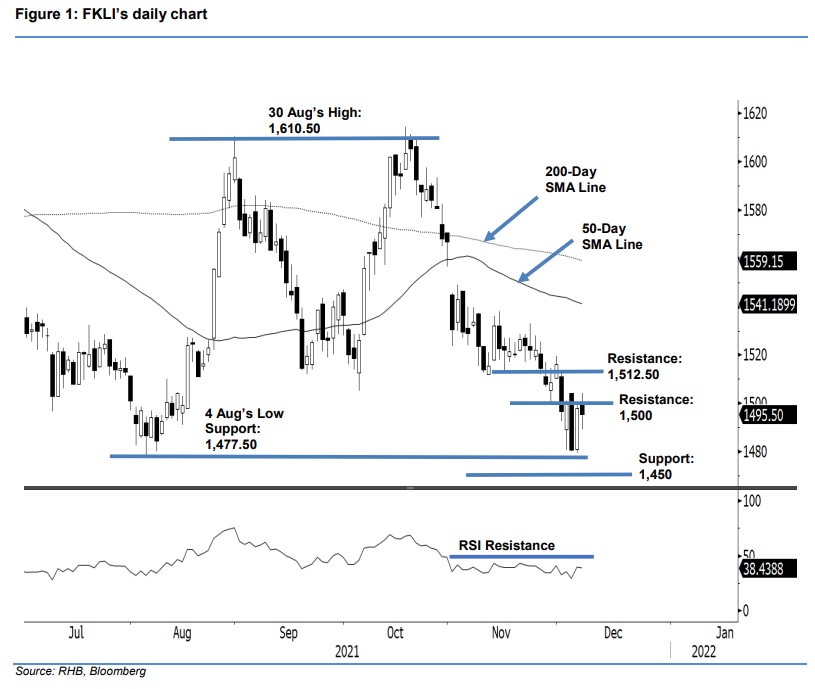

Maintain short positions. The FKLI’s upside movement was hampered by the psychological level of 1,500 pts, and it retraced 2.50 pts to close at 1,495.50 pts yesterday. It initially kicked off on bullish sentiment, gapping up at the open at 1,500.50 pts. However, the bears immediately took over after the index printed the day’s high of 1,504 pts, and strong profit-taking activity took it down to the day’s low of 1,489 pts. After that, the index charted a rebound and moved sideways for the rest of the session. At this stage, strong selling pressure persists at the 1,500-pt level. Coupled with the RSI trending below the 50% threshold, this indicates that the momentum should stay neutral in the sessions ahead. As long as the index stays below the psychological level, sentiment should tend towards negative, and the index could head for a downward correction. As such, we maintain a negative trading bias until the stop-loss is breached.

We advise traders to remain in short positions, which were initiated at 1,496.50 pts or the close of 1 Dec. To minimise the trading risks, the stop-loss is still at 1,517 pts.

The immediate support stays at 1,477.50 pts or the low of 4 Aug, then 1,450 pts. Conversely, the immediate resistance is at 1,500 pts, then 1,512.50 pts (1 Dec’s high).

Source: RHB Securities Research - 8 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024