WTI Crude: Bulls Taking a Breather

rhboskres

Publish date: Fri, 10 Dec 2021, 05:05 PM

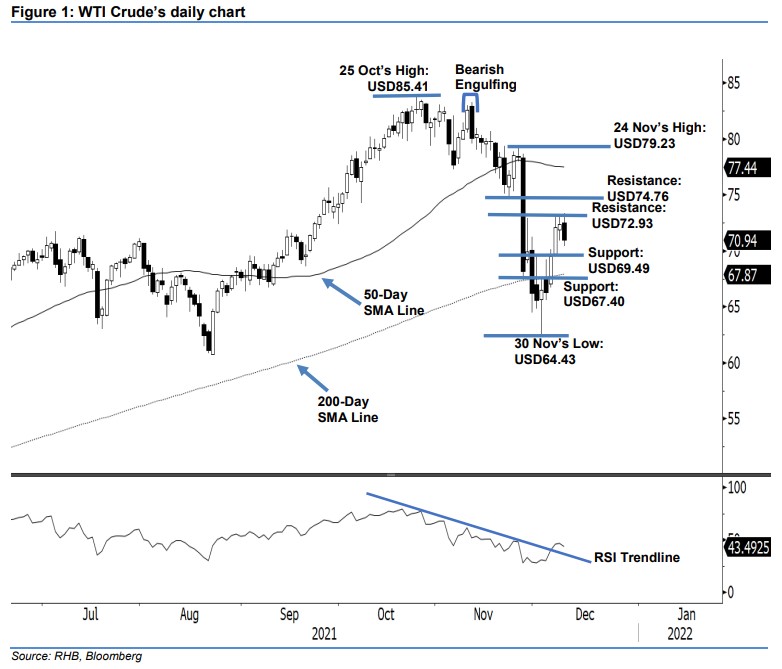

Maintain long positions. The WTI Crude paused the recent bullish momentum yesterday as it retreated USD1.42 to close at USD70.94. It started yesterday’s session at USD72.52, then hit the day’s high of USD73.34 during the early session before swiftly changing directions. Strong selling pressure then took place to drag the commodity towards the end of the session. It hit the intraday low of USD70.39 prior to close. With the latest pullback action, the bulls are taking a breather but are expected to still dominate the medium term sessions – while still forming a “higher high” bullish structure following recent rebound from its bottom. As long as the commodity continues to trade above the 200-day SMA line, the uptrend remains intact. As such, we keep to our positive trading bias.

We suggest traders maintain the long positions initiated at USD72.05, or the closing level of 7 Dec. To manage downside risks, the initial stop-loss is placed at USD67.40, ie below the 200-day average line.

The immediate support is fixed at USD69.49 (1 Dec’s high), followed by USD67.40, or the low of 26 Nov. The nearest resistance is pegged at USD72.93 (29 Nov’s high), followed by USD74.76, or 22 Nov’s low.

Source: RHB Securities Research - 10 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024