COMEX Gold: Downside Risk Remains

rhboskres

Publish date: Fri, 10 Dec 2021, 05:05 PM

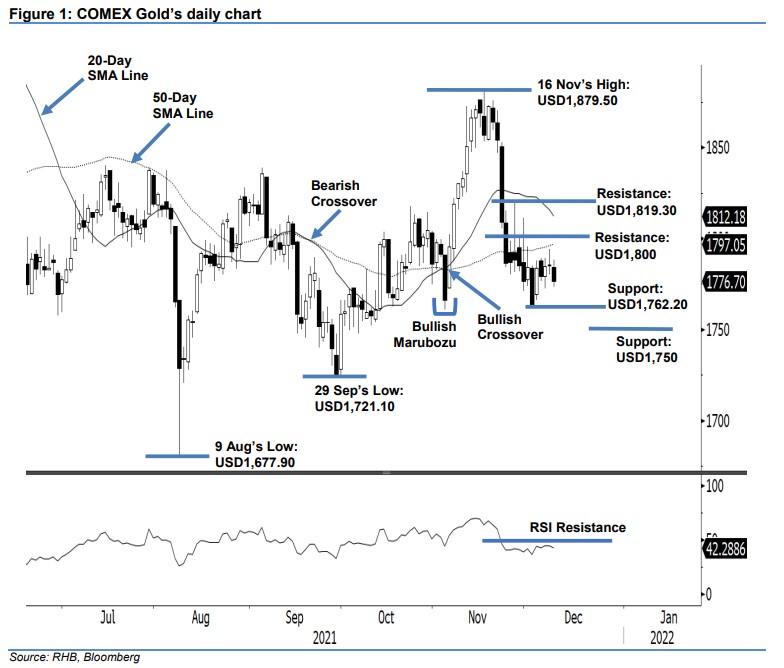

Maintain short positions. The COMEX Gold extended its consolidation mode yesterday, declining USD8.80 to settle at USD1,776.70. On Thursday, the commodity began at USD1,784.30 and edged higher to test the day’s high of USD1,788.40. It then drifted lower during the European trading session, reaching the day’s low of USD1,773.30 before the close. The precious metal has been undergoing a sideways consolidation since falling below the USD1,800 psychological level. Still, observe that the 20-day SMA line is trending lower and may cross below the 50-day SMA line. The next three trading sessions will be critical and if the bearish crossover happens, this will strengthen the current bearish setup. In the event the negative momentum accelerates, it may correct towards USD1,762.20, followed by USD1,750. For now, we continue holding on to our negative trading bias.

Traders should stick with the short positions initiated at USD1,809, or the closing level of 22 Nov. To mitigate trading risks, the stop-loss threshold is placed at USD1,825.

The immediate support remains unchanged at USD1,762.20 – 2 Dec’s low – followed by USD1,750. The nearest resistance stays at the USD1,800 round number, followed by USD1,819.30, or the high of 26 Nov.

Source: RHB Securities Research - 10 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024