Hang Seng Index Futures: Blocked by the Immediate Resistance

rhboskres

Publish date: Fri, 10 Dec 2021, 05:06 PM

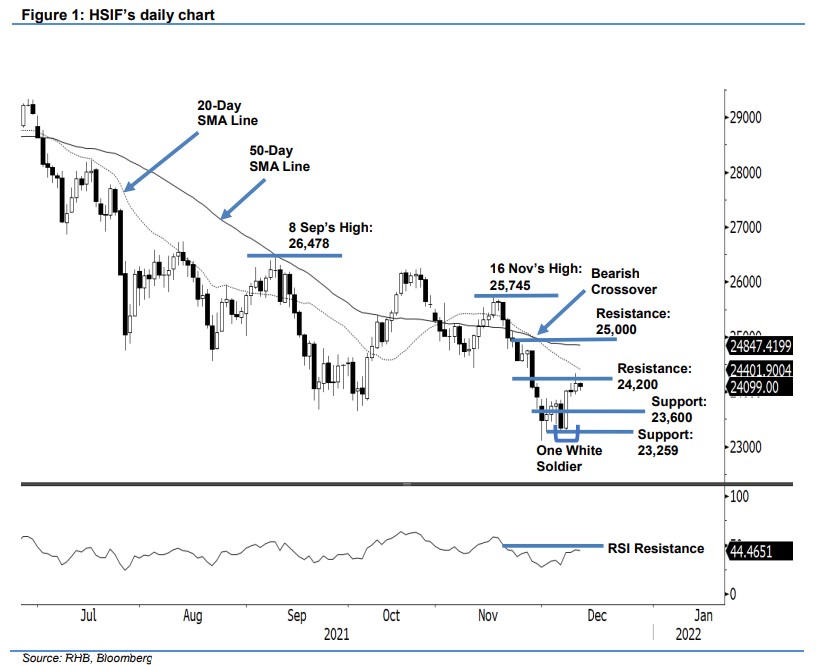

Maintain short positions. Yesterday saw the HSIF’s upside movement capped by the immediate resistance, despite rising 150 pts to settle the day’s session stronger at 24,153 pts. In the morning, the index jumped to open at 24,169 pts and rose to test the day’s high of 24,333 pts. But the momentum softened in the afternoon, retracing towards the day’s low of 24,151 pts before the close. It retreated another 54 pts in the evening session and last traded at 24,099 pts. As of now, the resistance of the 24,200-pt level remains intact and continues to prevent the index from going higher. Observe that the RSI is still hovering below the 50%, indicating a weak momentum now. The index may consolidate towards the 23,600-pt support in the immediate session before retesting the immediate resistance. We retain our negative trading bias until the index breaches the immediate resistance.

We recommend traders to stay with the short positions initiated at 24,892 pts, or the closing level of 19 Nov’s evening session. For trading-risk management, the trailing-stop is fixed at 24,200 pts – the immediate resistance.

The nearest support is established at 23,600 pts, followed by the lower support of 23,259 pts (1 Dec’s low). Conversely, the first resistance is pegged at 24,200 pts, followed by the next resistance at 25,000 pts.

Source: RHB Securities Research - 10 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024