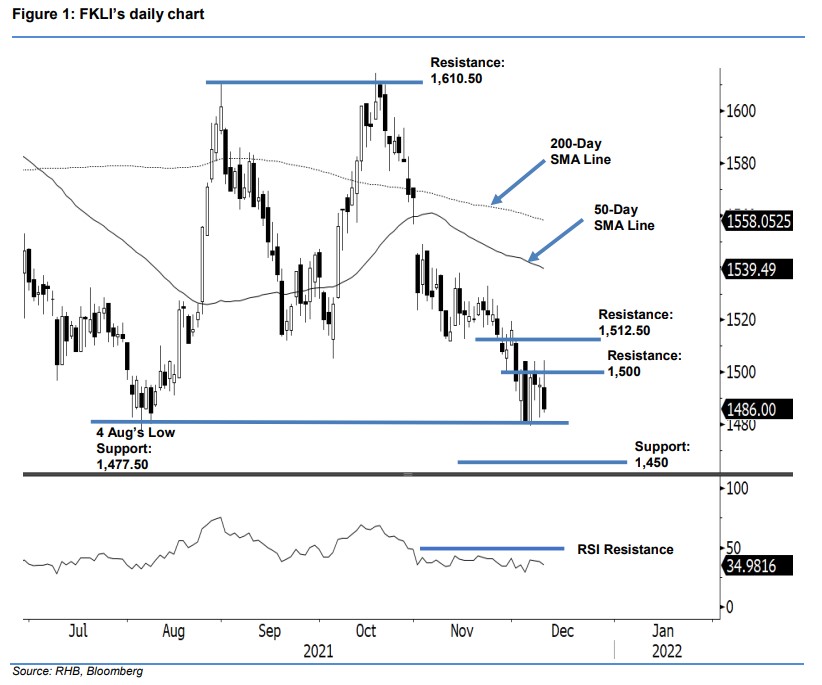

FKLI: Selling Pressure Garners Momentum

rhboskres

Publish date: Mon, 13 Dec 2021, 08:42 AM

Maintain short positions. The FKLI failed to cross above the 1,500-pt level, it retraced 9 pts to close weaker at 1,486 pts – the bears erased the the bulk gains made in the previous sessions. The index started off Friday’s session at 1,494 pts. Initially, it rose to touch the day’s high at 1,504.50 pts. However the bulls were not convinced and retraced below 1,500 pts, reaching the day’s low of 1,484.50 pts before the close. With the bears now in charge, the index may extend the selling momentum to test the 1,477.50-pt support in the coming sessions. Breaching the threshold would open door to more downside correction. As the bulls are at their weakest now, the 1,500-pt level remains as a tough psyhcologcial barrier. With the negative momentum picking up pace, we make no changes to our negative bias.

We recommend traders to retain the short positions that were initiated at 1,496.50 pts, or the close of 1 Dec. To protect the trading risks, the stop-loss is fixed at 1,517 pts.

The immediate support is kept at 1,477.50 pts (4 Aug’s low), followed by the subsequent support at 1,450 pts. Meanwhile, the immediate resistance is still at 1,500 pts, then 1,512.50 pts or the high of 1 Dec.

Source: RHB Securities Research - 13 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024