Hang Seng Index Futures: Consolidating Beneath the Immediate Resistance

rhboskres

Publish date: Mon, 13 Dec 2021, 08:44 AM

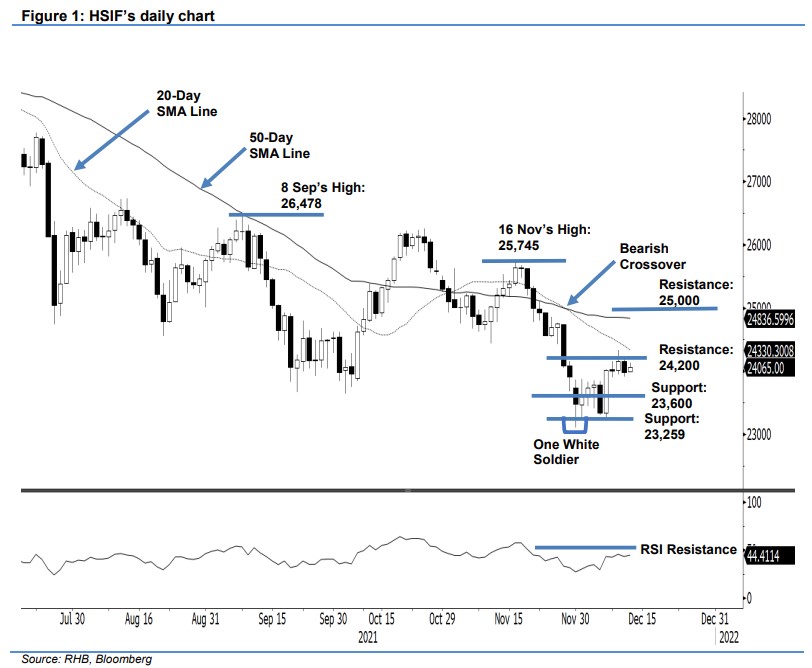

Maintain short positions. The HSIF managed to contain the selling pressure and consolidate just beneath the immediate resistance last Friday after falling 175 pts to settle the day’s session at 23,978 pts. The index started off weaker at 24,002 pts. After this weak opening, it rebounded to test the 24,222-pt day high. The HSIF then retraced in the afternoon to reach the 23,910-pt day low before the close. Encouraged by its US peers, the index staged a rebound during the evening session, climbing 87 pts. It last traded at 24,065 pts. Although the HSIF climbed higher lately on positive momentum – as supported by a rising RSI – the momentum has yet to cross the 24,200-pt resistance. Coupled with the RSI remaining below the 50% threshold, the recent rebound might be short-lived – the index may revert to a downside correction. In the event selling pressure accelerates again, the HSIF should decline to re-test the 23,600-pt immediate support. We keep to our negative trading bias until it breaks past the trailing stop.

We advise traders to hold on to short positions initiated at 24,892 pts, ie the closing level of 19 Nov’s evening session. To manage the trading risks, the trailing-stop level is set at the immediate resistance of 24,200 pts.

The first support formed at the 23,600 pts and is followed by the 23,259 pts, or the low of 1 Dec’s low. On the upside, the nearest resistance is eyed at 24,200 pts and followed by the higher resistance of 25,000 pts.

Source: RHB Securities Research - 13 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024