WTI Crude: Intraday Bulls Turn to Bears

rhboskres

Publish date: Tue, 14 Dec 2021, 08:36 AM

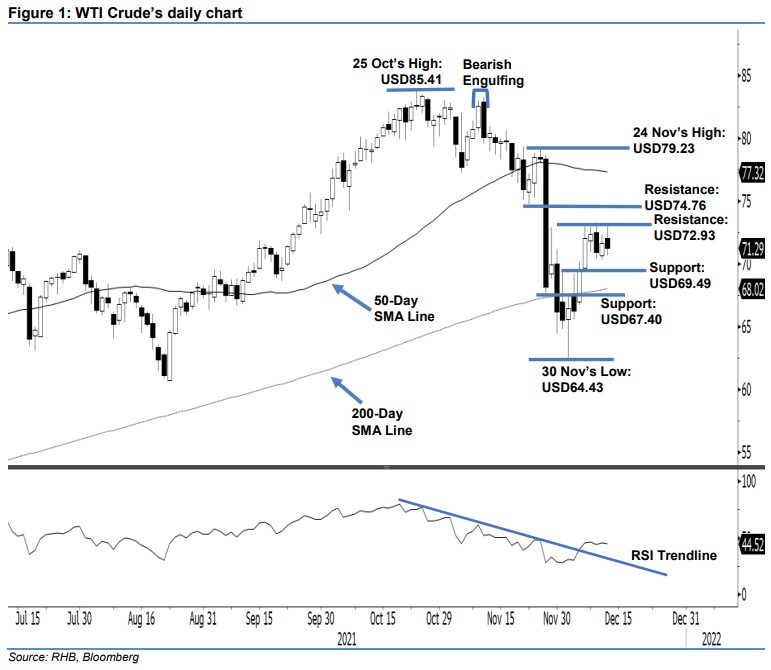

Maintain long positions. The WTI Crude wrote off its intraday gains to close in a negative direction yesterday, as it closed USD0.38 lower at USD71.29. It opened higher at USD72.04 and continued to move northwards towards hitting the intraday high of USD73.00. Selling pressure then emerged ahead of the European trading session, which saw the commodity falling strongly towards the day’s low at USD70.71 before rebounding moderately towards the close. The latest black body candlestick with long upper shadow indicates heightened selling pressure below the USD72.93 immediate resistance. Hence, we expect the WTI Crude to retrace lower towards the immediate support of USD69.49 in the coming sessions – before potentially rebounding positively northwards. As long as the commodity continues to trade above the 200-day SMA line, the medium-term uptrend remains intact. As such, we keep to our positive trading bias unless the stop-loss mark is triggered.

We suggest traders stay in the long positions initiated at USD72.05, ie the closing level of 7 Dec. To manage the downside risks, the initial stop-loss threshold is pegged at USD67.40 or below the 200-day average line.

The immediate support is still at USD69.49 – 1 Dec’s high – and is followed by USD67.40, ie the low of 26 Nov. The nearest resistance is fixed at USD72.93 – 29 Nov’s high – and followed by USD74.76, or 22 Nov’s low.

Source: RHB Securities Research - 14 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024