COMEX Gold: Mild Bullish Momentum

rhboskres

Publish date: Tue, 14 Dec 2021, 08:37 AM

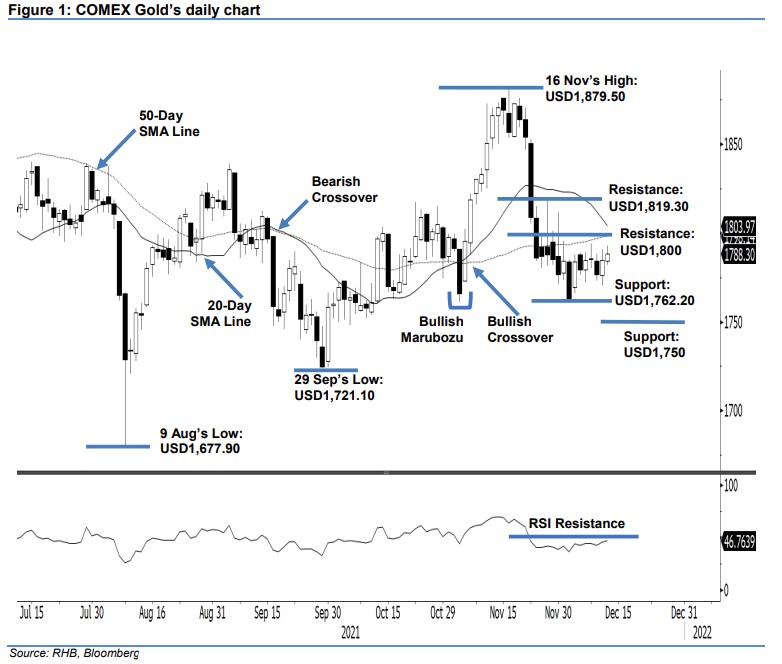

Maintain short positions. The COMEX Gold experienced brief buying interest yesterday, climbing USD3.50 to settle at USD1,788.30. The yellow metal started off the session at USD1,784.20. It then progressed higher and reached the USD1,792.80 day high. Although there was a strong profit-taking after the commodity reached its intraday high, the selling pressure was contained – it closed higher than the opening at USD1,788.30. For the past two sessions, buying pressure has been greater then selling pressure. However, the COMEX Gold is still capped below the 50-day SMA line. Coupled with the RSI still languishing below the 50% level, the momentum remains weak. Hence, we expect to see the commodity to move sideways for the immediate session. For now, we keep to our negative trading bias until the stop-loss point is breached.

Traders should retain the short positions initiated at USD1,809, ie the closing level of 22 Nov. To manage the trading risks, the stop-loss threshold is fixed at USD1,825.

The immediate support stays at USD1,762.20 – 2 Dec’s low – and is followed by the lower support of USD1,750. On the upside, the nearest resistance remains unchanged at the USD1,800 round number, followed by USD1,819.30, or the high of 26 Nov.

Source: RHB Securities Research - 14 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024