E-Mini Dow: Selling Pressure Emerges From the Top

rhboskres

Publish date: Tue, 14 Dec 2021, 08:38 AM

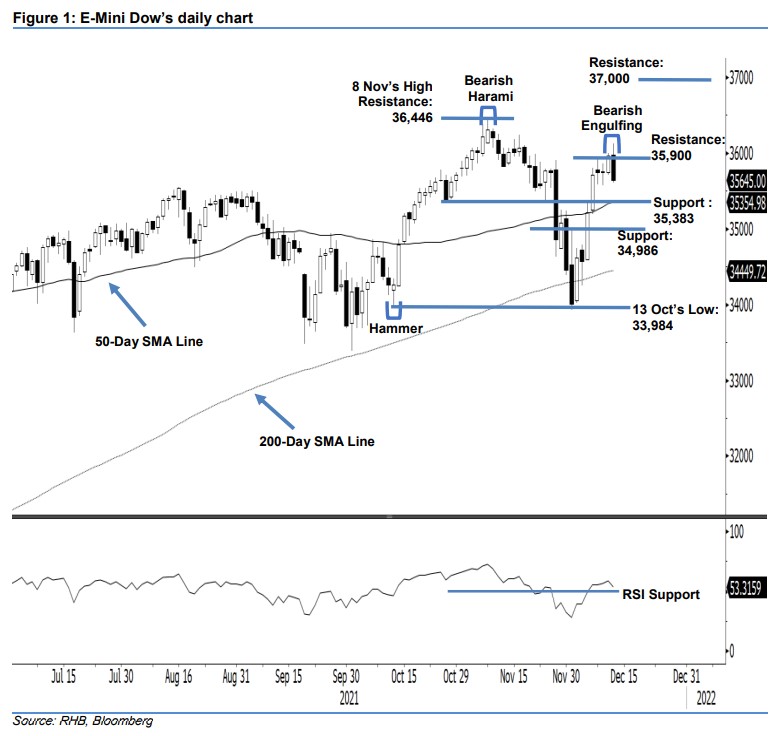

Maintain long positions. The E-Mini Dow reversed its momentum to negative yesterday, closing 322 pts down at 35,645 pts and backpedalling its direction from an intraday high to close lower. It opened at 35,975 pts and climbed higher ahead of the Asian trading session to hit the 36,123-pt intraday high. It then moved in a sideways direction before selling pressure kicked in late during the European trading session, which dragged it down until the end of the session – hitting the day’s bottom of 35,602 pts before oscillating towards the close. The recent “Bearish Engulfing” candlestick breaching below the immediate support-turned-resistance has nullified the latest breakout. Selling pressure is expected to persist in the coming sessions to drag the E-Mini Dow lower towards the 35,383-pt support, which is also its trailing stop. If it breaches below this, the medium-term direction will shift southwards. For now, we see current selling pressure as a sign of strong profit-taking in the coming sessions before it rebounds higher above the immediate support. Unless the trailing stop is triggered, we stay with our positive trading bias.

We suggest traders stick to the long positions initiated at 35,212 pts. For risk-management purposes, the initital trailing-stop point is set at 35,383 pts.

The immediate support is revised at 35,383 pts – the high of 27 Oct’s low – and followed by 34,986 pts, ie the high of 1 Dec. The immediate resistance levels are set at 35,900 pts – 26 Nov’s high – and 36,446 pts, or 8 Nov’s high.

Source: RHB Securities Research - 14 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024