COMEX Gold: Negative Momentum Gathering Pace

rhboskres

Publish date: Wed, 15 Dec 2021, 06:03 PM

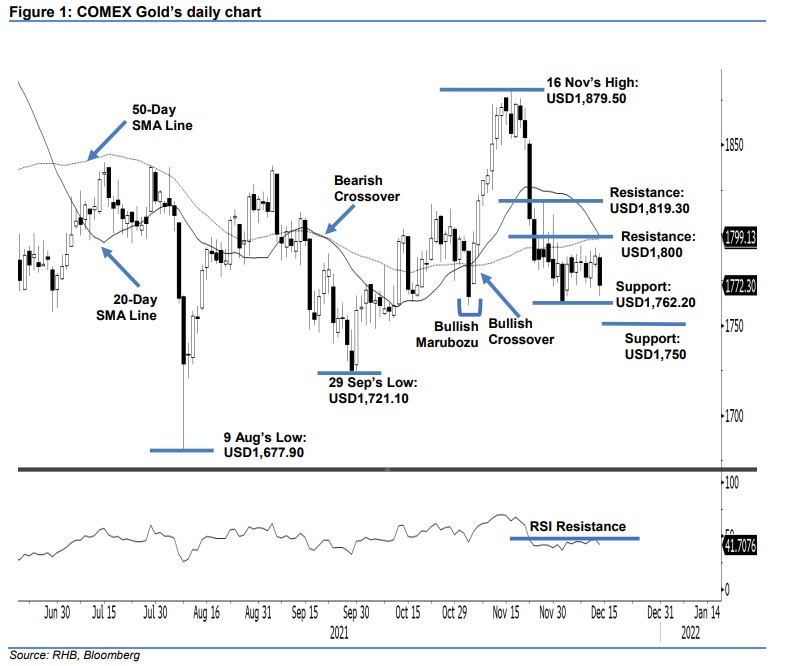

Maintain short positions. The COMEX Gold saw negative momentum picking up pace again yesterday – the index retreated USD16.00 to settle at USD1,772.30. It began the session at USD1,787.60 and moved sideways for most of the session. In the evening, it fell rapidly to the day’s low of USD1,766.10 before the close – printing a long black body candlestick. With the negative price action, the bears are now in control. We observed that the 20-day SMA line has crossed below the 50-day SMA line, further strengthening the bearish technical setup. The COMEX Gold may drift lower to test the immediate support of USD1,762.20. As the commodity is facing renewed selling pressure, we make no change to our negative trading bias.

We advise traders to keep the short positions initiated at USD1,809, or the closing level of 22 Nov. To mitigate trading risks, the stop-loss threshold is set at USD1,825.

The immediate support is marked at USD1,762.20 (2 Dec’s low), followed by the lower support of USD1,750. Conversely, the nearest resistance is at USD1,800, followed by USD1,819.30, or the high of 26 Nov.

Source: RHB Securities Research - 15 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024