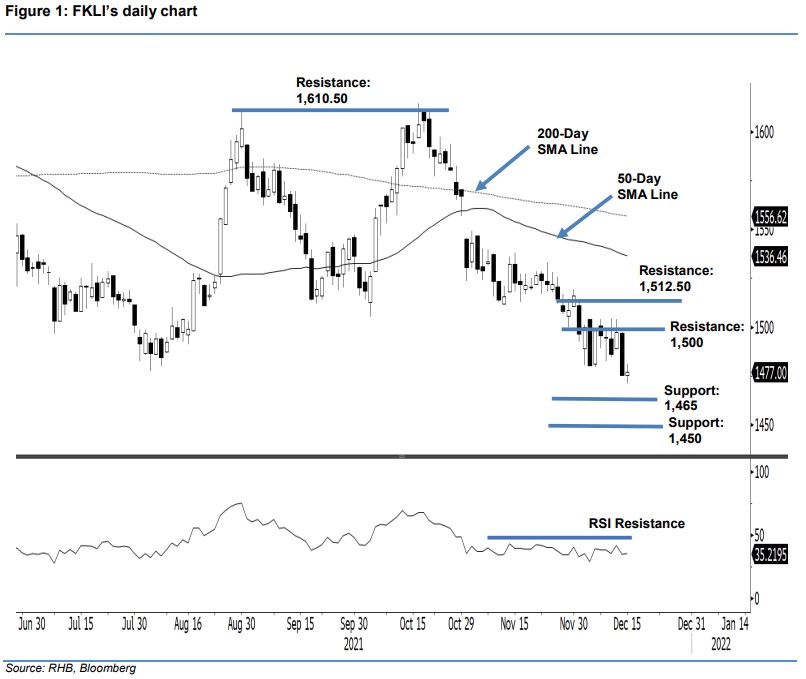

FKLI: Still In Correction Phase

rhboskres

Publish date: Thu, 16 Dec 2021, 05:23 PM

Maintain short positions. The FKLI saw selling pressure ease yesterday, rebounding 1.50 pts to settle at 1,477 pts. The index initially sarted off at 1,475.50 pts. After languishing between 1,481 pts and 1,471 pts, it closed at 1,477 pts. Despite the FKLI closing in positive territory yesterday, it has corrected to the low of 2021. As we have yet to see a formation of a bullish reversal pattern, the index is still bounded by the correction phase. In a typical correction phase, the resistance tends to hold while the support is weak. A technical rebound will meet stiff resistance at the 1,500-pt level. If the selling pressure resumes, the index may test the next support at 1,465 pts followed by 1,450-pt level. As of now, we hold on to our negative trading bias.

Traders are recommended to keep the short positions initiated at 1,496.50 pts – the close of 1 Dec. To manage the trading risks, the stop-loss threshold is placed at 1,517 pts.

The immediate support is marked at 1,465 pts, followed by the lower support of 1,450 pts. Meanwhile, the first resistance stays at 1,500 pts, and is followed by the 1,512.50-pt hurdle, which was the high of 1 Dec.

Source: RHB Securities Research - 16 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024