Hang Seng Index Futures: Attempting to Extend the Technical Rebound

rhboskres

Publish date: Fri, 17 Dec 2021, 04:31 PM

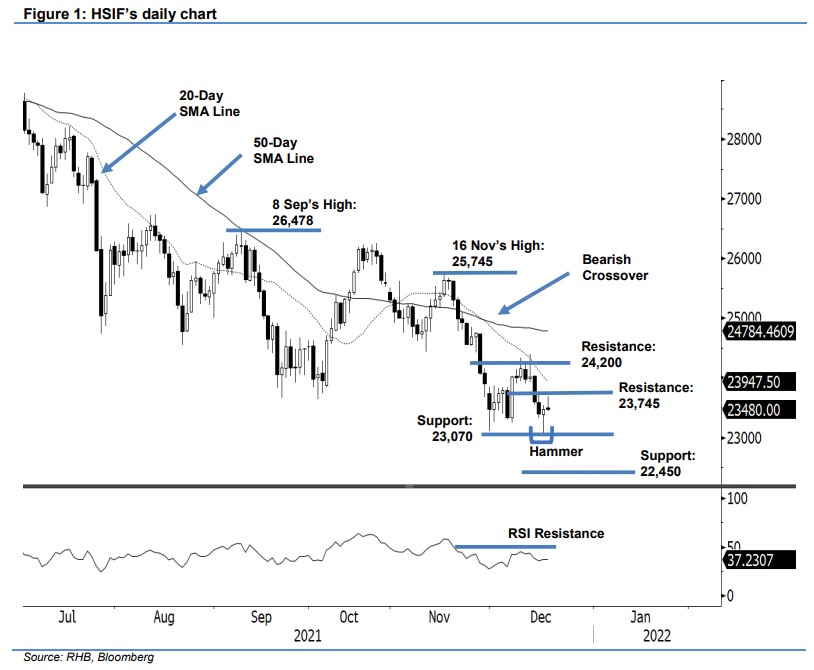

Maintain short positions. The HSIF managed to contain the selling pressure, rebounding 82 pts to settle at 23,479 pts. It started off the morning session weaker at 23,288 pts, and then corrected towards the session’s 23,139-pt low. Sentiment improved as the session progressed, with the index paring its intraday losses, and climbing to test the session’s 23,533-pt high before the close. In the evening session, it managed to touch the session’s high of 23,695 pts before retracing. It last traded at 23,480 pts. We observed that the HSIF formed a Hammer candlestick pattern, indicating that it has found an interim low at 23,070 pts. If bullish momentum continues, the index may attempt to test 15 Dec’s high of 23,745 pts. Meanwhile, the HSIF’s bearish structure will be deemed valid as long as it continues to trade below the 20-day SMA line. We maintain our negative trading bias until the index breaks past the trailing-stop.

Traders are advised to retain the short positions initiated at 24,892 pts, or the closing level of 19 Nov’s evening session. To mitigate trading risks, the trailing-stop is fixed at 24,200 pts.

The immediate support is revised to the Hammer’s low of 23,070 pts, followed by 22,450 pts. Meanwhile, the nearest resistance is pegged at 23,745 pts – 15 Dec’s high – followed by the 24,200-pt whole number.

Source: RHB Securities Research - 17 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024

.png)