WTI Crude: Rebounding Higher Above the Immediate Support

rhboskres

Publish date: Fri, 17 Dec 2021, 04:32 PM

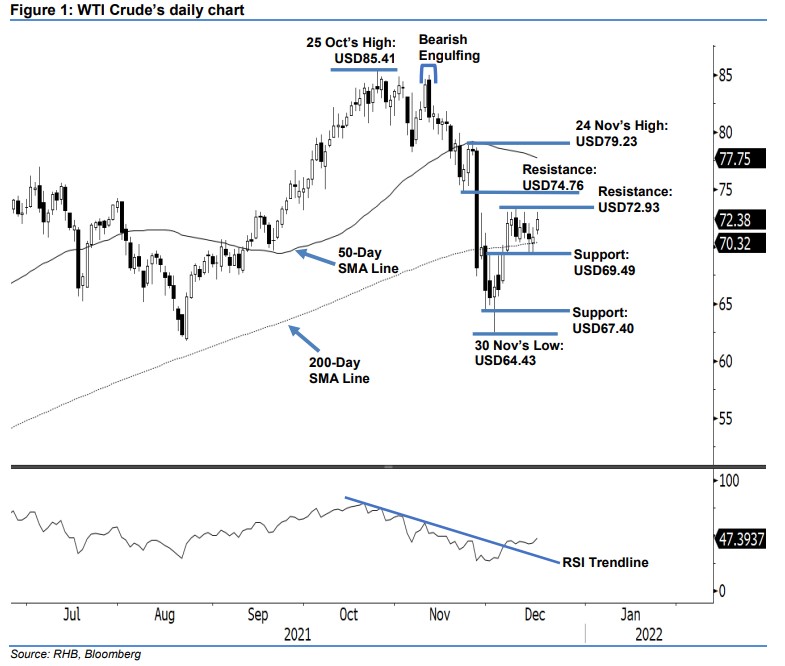

Maintain long positions. The WTI Crude rebounded strongly above the immediate support and 200-day SMA line yesterday after jumping USD1.51 to close at USD72.38 – heading towards the USD72.93 immediate resistance. The black gold opened higher at USD71.48 and oscillated sideways towards the late European session, where the WTI Crude whipsawed in volatile fashion. Strong buying pressure emerged, followed by strong selling pressure, before it hit the day’s bottom at USD71.03. Buying momentum then re-emerged ahead of the US trading session to propel the black gold towards the USD72.99 day high before retracing moderately towards the close. The latest white body candlestick with long upper shadow suggests the buying momentum above the immediate support level is getting more obvious in the medium term. Nevertheless, the intraday profit-taking yesterday signalled the odds of mild profit-taking or sideways movements in the immediate sessions. This is also supported by the strengthening of the RSI, as it eyes to move higher towards the 50% level. As such, we retain our positive trading bias.

We suggest traders stick to the long positions initiated at USD72.05, ie the closing level of 7 Dec. To manage the downside risks, the stop-loss threshold is revised to USD69.49, ie below the 200-day average line.

The immediate support is set at USD69.49 – 1 Dec’s high – and followed by USD67.40, or the low of 26 Nov. The nearest resistance is pegged at USD72.93 – 29 Nov’s high – and followed by USD74.76, ie 22 Nov’s low.

Source: RHB Securities Research - 17 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024