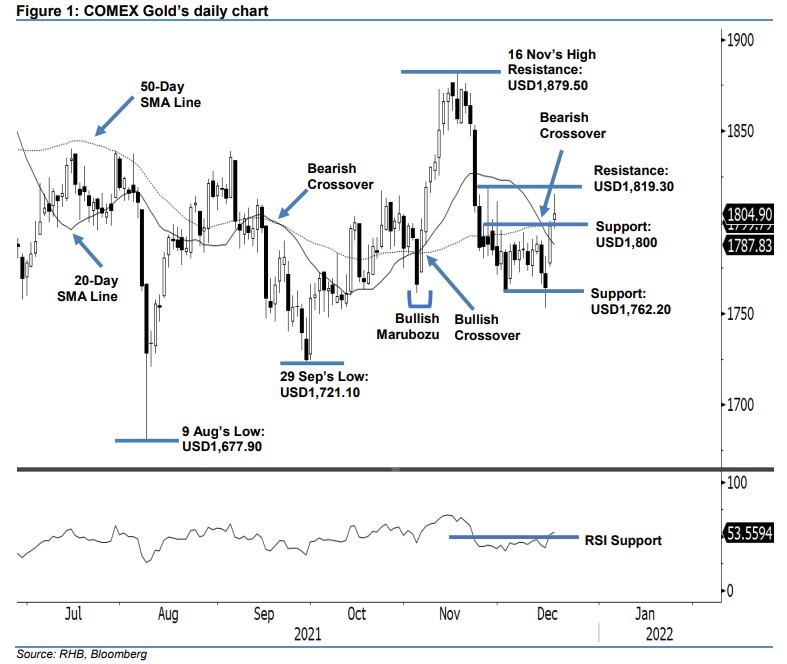

COMEX Gold: Jumping Above the 50-Day SMA Line

rhboskres

Publish date: Mon, 20 Dec 2021, 08:35 AM

Maintain short positions. The COMEX Gold continued to surge last Friday amid strong intraday profit taking, closing USD6.70 higher at USD1,804.90 – above the 50-day average line. It gapped up again to open at USD1,801.50 and propelled towards the intraday high of USD1,815.70 during the opening US trading session. Selling pressure then kicked in causing a change in direction southwards, falling strongly until the end of the session. It touched the intraday low of USD1,796.5 before rebounding moderately towards the close. The white body candlestick with a long upper shadow printed last Friday suggests it is expected to trade positively between the USD1,800 support and USD1,819.30 resistance in the medium term – supported by the strengthening of the RSI above the 50% level. Nevertheless, mild profit-taking activities are expected to occur near the immediate support in the coming sessions. We keep to our negative trading bias until the revised stop-loss is breached.

We advise traders to stick with the short positions initiated at USD1,809, or the closing level of 22 Nov. For risk management, the stop-loss is revised lower to USD1,819.30.

The immediate support is set at USD1,800, followed by USD1,762.20 – 2 Dec’s low. On the upside, the nearest resistance is eyed at USD1,819.30 – 26 Nov’s high, followed by USD1,879.50 (16 Nov’s high).

Source: RHB Securities Research - 20 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024