Hang Seng Index Futures: Selling Pressure Persisting

rhboskres

Publish date: Mon, 20 Dec 2021, 08:43 AM

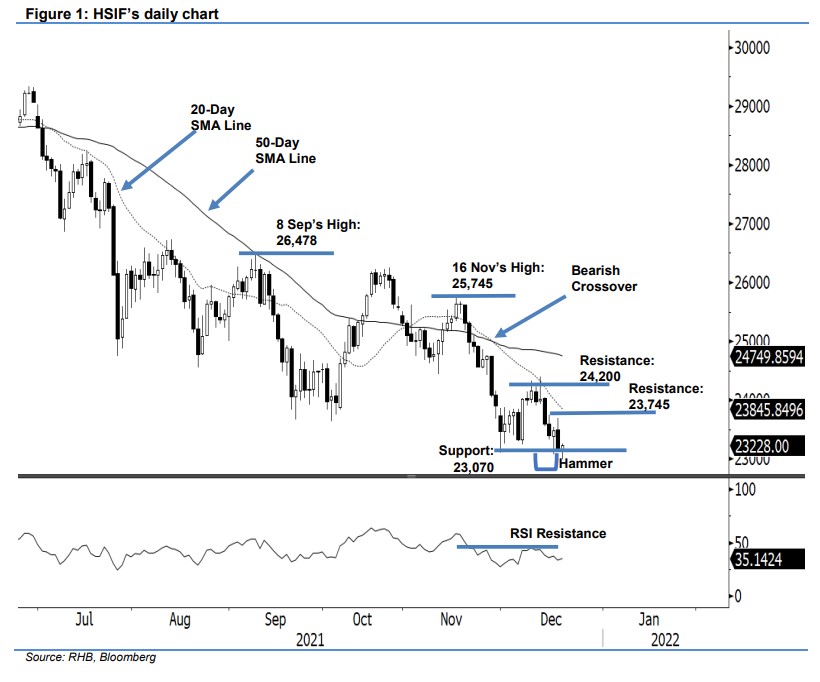

Maintain short positions. The HSIF failed to sustain its intraday high last Friday, giving up all intraday gains to close 337 pts lower at 23,142 pts. It opened at 23,497 pts to immediate hit the intraday high of 23,257 pts before changing its direction towards south and falling until the end of the session to hit the day’s low of 23,142 pts. In the evening session, it managed to touch the session’s high of 23,257 pts before falling further. It last traded at 23,228 pts. We observed that the HSIF formed a long black candlestick pattern following Thursday’s hammer candlestick, signalling that the potential reversal has been cancelled by strong selling pressure last Friday. Hence, the HSIF’s bearish pattern will be deemed valid as long as it continues to trade below the 20-day SMA line. We stick to our negative trading bias unless the index moves higher, passing above the trailing-stop.

Traders are suggested to keep the short positions initiated at 24,892 pts, or the closing level of 19 Nov’s evening session. To mitigate trading risks, the trailing-stop is set at 24,200 pts.

The immediate support is still at 23,070 pts – 16 Dec’s low, followed by 22,450 pts. Meanwhile, the nearest resistance is pegged at 23,745 pts – 15 Dec’s high – followed by the 24,200-pt whole number.

Source: RHB Securities Research - 20 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024