WTI Crude: Retracing Towards the Immediate Support

rhboskres

Publish date: Mon, 20 Dec 2021, 08:44 AM

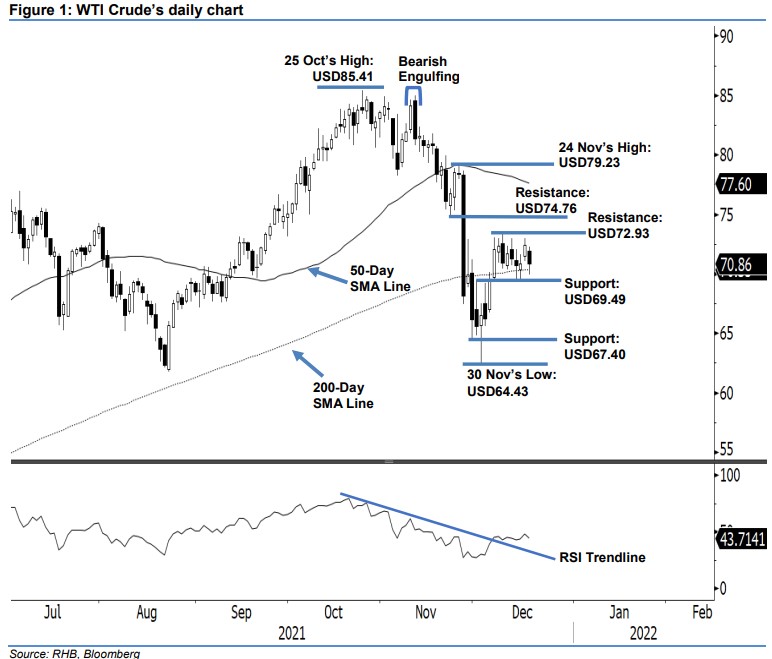

Maintain long positions. The WTI Crude pulled back from the recent rebound last Friday as it fell USD1.52 to close at USD70.86 – attempting to drag below the 200-day SMA line. The black gold opened lower at USD71.92 and whipsawed in a downward direction after touching the day’s high of USD72.26 during the early session. It hit the day’s bottom at USD69.89 before rebounding mildly towards the close. The latest black body candlestick with lower shadow suggests the buying momentum above the immediate support has receded and is expected to move weaker towards the USD69.49 support – in line with our earlier expectations. The negative momentum is expected to emerge if the commodity falls below the immediate support, likely printing a “lower low” bearish structure – also below the 200-day SMA line. Supported by the RSI’s weaker momentum, below the 45% level, we do not expect the WTI Crude to rebound any time soon. Since the stop-loss level has yet to be breached, we keep to our positive trading bias.

We advise traders keep to the long positions initiated at USD72.05, ie the closing level of 7 Dec. To manage the downside risks, the stop-loss threshold is pegged at USD69.49, ie the immediate support level.

The immediate support is set at USD69.49 – 1 Dec’s high – followed by USD67.40, or the low of 26 Nov. The nearest resistance is eyed at USD72.93 – 29 Nov’s high – followed by USD74.76, ie 22 Nov’s low.

Source: RHB Securities Research - 20 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024