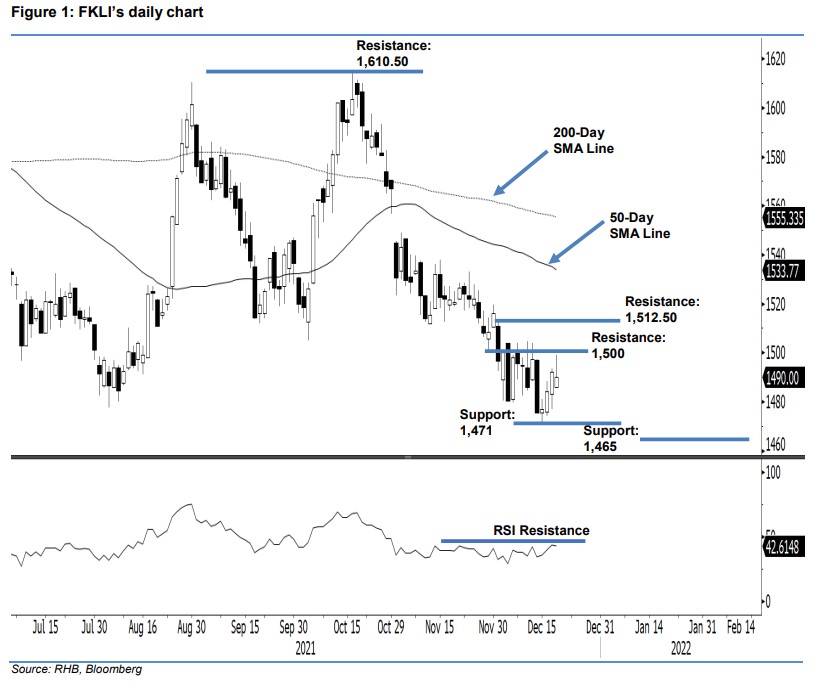

FKLI: Capped By 1,500-Pt Resistance

rhboskres

Publish date: Tue, 21 Dec 2021, 08:36 AM

Maintain short positions. The FKLI ceded all intraday gains yesterday, closing just 2 pts lower at 1,490 pts. Despite opening lower at 1,486 pts, the benchmark index immediately climbed higher towards the 1,499-pt intraday high during the early trading session. Selling pressure then kicked in, and the index turned south to print the intraday low of 1,485.5 pts before rebounding mildly at the close – slightly above the opening, but below the previous day’s closing. The latest white body candlestick with long upper shadow reaffirms our expectation that the movement is capped at the 1,500-pt level – as selling pressure emerged near this level to drag the intraday high to close lower – coupled with RSI strength remaining below 50%. With that, we will hold on to our negative trading bias until the stop-loss is triggered.

Traders should remain in short positions that were initiated at 1,496.50 pts – the close of 1 Dec. To mitigate the trading risks, the stop-loss has been set at 1,512.50 pts – its resistance at 1 Dec’s high.

The immediate support is still at 1,471 pts – 15 Dec’s low – then 1,465 pts. On the upside, the nearest resistance is fixed at 1,500 pts, followed by 1,512.50 pts or the high of 1 Dec.

Source: RHB Securities Research - 21 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024