WTI Crude: Breaching Below the Immediate Support

rhboskres

Publish date: Tue, 21 Dec 2021, 08:41 AM

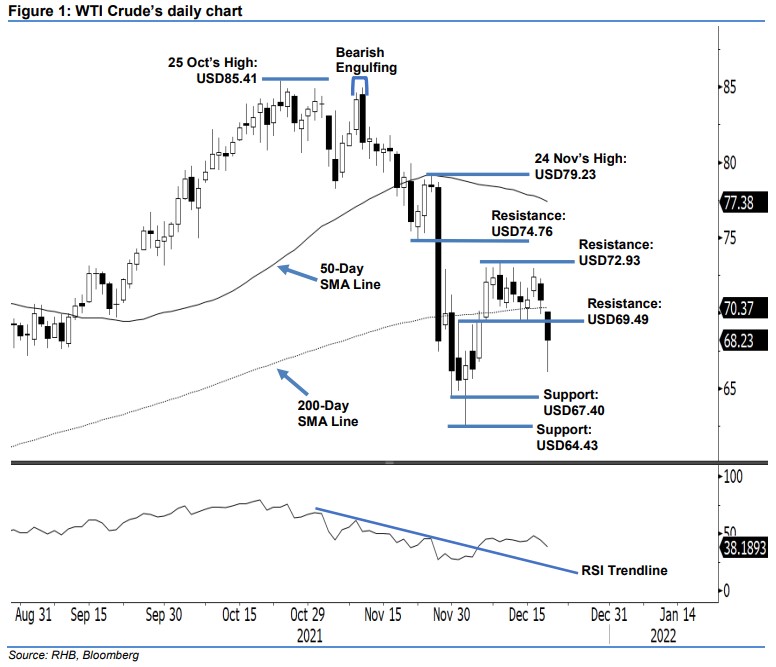

Stop-loss triggered; initiate short positions. The WTI Crude fell sharply beneath the immediate support yesterday, as it fell USD2.63 to close at USD68.23 – also below the 200-day average line. The black gold opened lower at USD70.07 and immediately moved southwards throughout the session – it hit the intraday low of USD66.04 during the mid US session before rebounding moderately towards the close. The latest black body candlestick with a long lower shadow below the long term average line suggests strong selling momentum has emerged to drag the WTI Crude lower towards the USD67.40 immediate support in the coming sessions – as it printed the “lower low” bearish structure. Coupled by the RSI’s weaker momentum, below the 40% level, we expect the bearish momentum to persist in the medium term. Since the stop-loss level has been breached, we shift to a negative trading bias.

We closed out our long positions, initiated at USD72.05, or the closing level of 7 Dec, after the stop-loss at USD69.49 was triggered. Conversely, we initiate short positions at the closing level of 20 Dec at USD68.23. To manage the downside risks, the initial stop-loss threshold is placed at the USD72.93 resistance level.

The immediate support is revised to USD67.40 – 26 Nov’s low – followed by USD64.43, or the low of 30 Nov. The nearest resistance is set at USD69.49 – 1 Dec’s high – followed by USD72.93, ie 29 Nov’s high.

Source: RHB Securities Research - 21 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024