FCPO: Bears Take a Breather

rhboskres

Publish date: Wed, 22 Dec 2021, 04:42 PM

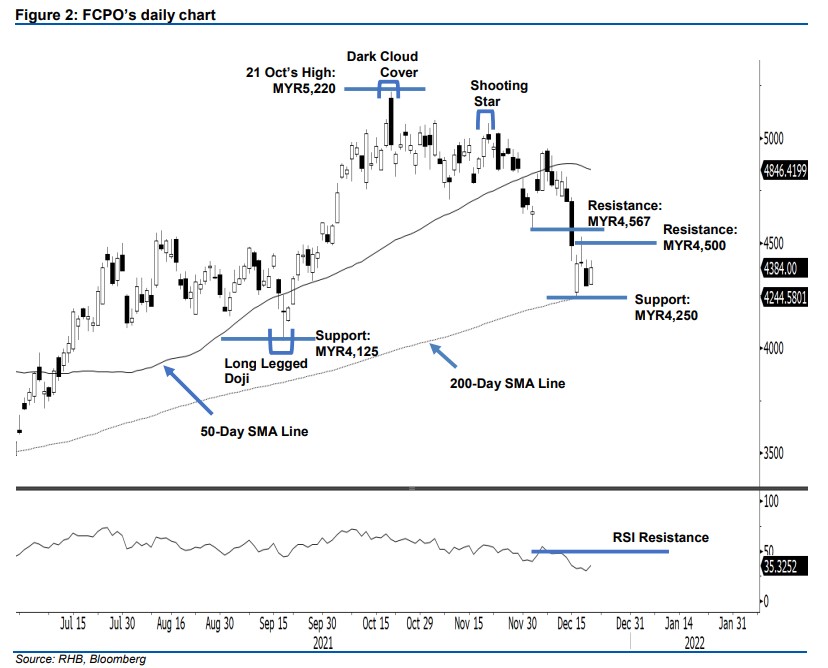

Keep short positions. The FCPO paused its downward movement yesterday, as it bounced to settle MYR89.00 higher at MYR4,384 – above the 200-day average line of MYR4,241. The commodity opened at MYR4,304 yesterday, and climbed gradually towards the day’s high of MYR4,418 before retreating towards the close at MYR4,384. The latest white body candlestick, following the recent pullback, printed a “higher low” bullish structure above the 200-day SMA line – we expect a mild rebound in the immediate term. This is supported by the strengthening of the RSI from below 30% to 35% yesterday. Nevertheless, the medium-term bearish momentum remains intact below the MYR4,500 resistance level, as it has yet to form a “higher high” bullish structure. This is coupled with the RSI remaining below the 50% level. Until the trailing-stop is triggered, we stick to our bearish trading bias.

We recommend that traders maintain the short positions initiated at MYR4,699, or the closing level of 14 Dec. To manage trading risks, the trailing-stop is set at MYR4,567 – the low of 2 Dec.

The immediate support is eyed at MYR4,250, followed by MYR4,125. Towards the upside, the immediate resistance is pegged at MYR4,500, while the higher hurdle is set at MYR4,567, or 2 Dec’s low.

Source: RHB Securities Research - 22 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024