E- Mini Dow: Bouncing Off the Immediate Support

rhboskres

Publish date: Wed, 22 Dec 2021, 04:46 PM

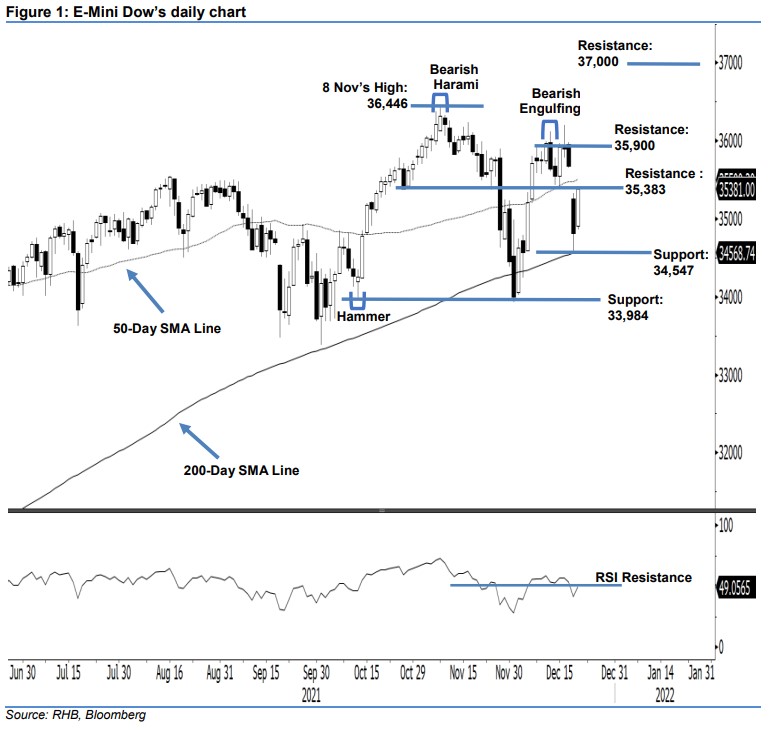

Maintain short positions. The E-Mini Dow rebounded strongly yesterday as it climbed 568 pts to close at 35,381 pts, bouncing off the immediate support and 200-day SMA line. It opened higher at 34,907 pts, with the bullish momentum persisting to head north throughout the session. It hit the intraday’s high of 35,413 pts before the close. The long white body candlestick which appeared yesterday – following Monday’s selling pressure – suggests the downtrend movement has been reversed in the immediate term. We expect the E-Mini Dow to continue climbing higher, but capped by the 35,900-pt resistance. The medium term prospect remains bearish unless the 35,900-pt resistance is breached. This immediate term bullish bias is supported by the improving RSI yesterday which was pointing higher, while the bearish outlook is supported by the RSI strength that is still below the 50% threshold. Based on our medium term outlook, we keep to our bearish trading bias until the stop-loss is triggered.

Traders are suggested to keep the short positions initiated at the closing level of 20 Dec at 34,813 pts. For risk-management purposes, the initial stop-loss threshold is set at 35,900 pts.

The immediate support is set at 34,547 pts – 20 Dec’s low – followed by 33,984 pts, or the high of 1 Dec. The immediate resistance levels are still at 35,383 pts (27 Nov’s low), and 35,900 pts (26 Nov’s high).

Source: RHB Securities Research - 22 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024