COMEX Gold: Bearish Momentum Continues

rhboskres

Publish date: Wed, 22 Dec 2021, 04:47 PM

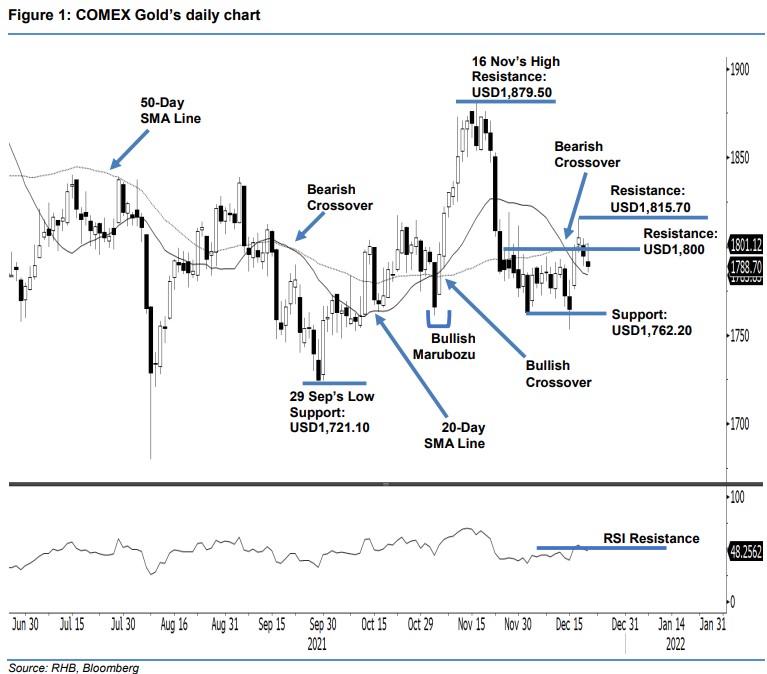

Maintain short positions. The COMEX Gold continued its bearish momentum, falling USD5.90 to settle at USD1,788.70 yesterday – giving up its intraday profits to close further away from the USD1,800 resistance. It opened slightly lower at USD1,791.40, and whipsawed until strong buying pressure emerged during the European trading session to propel the yellow metal towards the day’s USD1,801.70 high. The positive momentum turned negative during the US trading session, which saw it fall strongly towards the day’s low of USD1,785 before rebounding mildly to close. The black body candlestick with long upper shadow – formed below the USD1,800 resistance – shows the recent selling momentum. We expect the COMEX Gold to move sideways near the 20- day average line in the upcoming sessions before rebounding. This is supported by the weakening of the RSI, which is pointing below the 50% level. We keep our negative trading bias until the stop-loss is triggered.

We suggest traders keep the short positions initiated at USD1,809, or the closing level of 22 Nov. For risk management, the stop-loss is placed at USD1,815.70 resistance. The immediate support is eyed at USD1,762.20 – 2 Dec’s low – followed by USD1,721.10, which was 29 Sep’s low. On the upside, the nearest resistance is set at the USD1,800 threshold, followed by USD1,815.70, or 17 Dec’s high.

Source: RHB Securities Research - 22 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024